Question: show work in excel please! Question 4 (40 points) ACME Widget Company has been selling ochre widgets as fast as they can produce them. Management

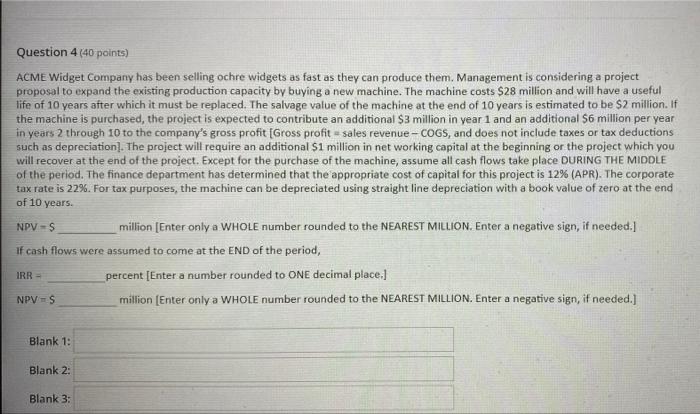

Question 4 (40 points) ACME Widget Company has been selling ochre widgets as fast as they can produce them. Management is considering a project proposal to expand the existing production capacity by buying a new machine. The machine costs $28 million and will have a useful life of 10 years after which it must be replaced. The salvage value of the machine at the end of 10 years is estimated to be $2 million. If the machine is purchased, the project is expected to contribute an additional $3 million in year 1 and an additional $6 million per year in years 2 through 10 to the company's gross profit [Gross profit = sales revenue - COGS, and does not include taxes or tax deductions such as depreciation]. The project will require an additional $1 million in net working capital at the beginning or the project which you will recover at the end of the project. Except for the purchase of the machine, assume all cash flows take place DURING THE MIDDLE of the period. The finance department has determined that the appropriate cost of capital for this project is 12% (APR). The corporate tax rate is 22%. For tax purposes, the machine can be depreciated using straight line depreciation with a book value of zero at the end of 10 years. NPV - 5 million (Enter only a WHOLE number rounded to the NEAREST MILLION. Enter a negative sign, if needed.] if cash flows were assumed to come at the END of the period, percent (Enter a number rounded to ONE decimal place.) NPV - S million (Enter only a WHOLE number rounded to the NEAREST MILLION. Enter a negative sign, if needed.) IRR = Blank 1: Blank 2: Blank 3: Question 4 (40 points) ACME Widget Company has been selling ochre widgets as fast as they can produce them. Management is considering a project proposal to expand the existing production capacity by buying a new machine. The machine costs $28 million and will have a useful life of 10 years after which it must be replaced. The salvage value of the machine at the end of 10 years is estimated to be $2 million. If the machine is purchased, the project is expected to contribute an additional $3 million in year 1 and an additional $6 million per year in years 2 through 10 to the company's gross profit [Gross profit = sales revenue - COGS, and does not include taxes or tax deductions such as depreciation]. The project will require an additional $1 million in net working capital at the beginning or the project which you will recover at the end of the project. Except for the purchase of the machine, assume all cash flows take place DURING THE MIDDLE of the period. The finance department has determined that the appropriate cost of capital for this project is 12% (APR). The corporate tax rate is 22%. For tax purposes, the machine can be depreciated using straight line depreciation with a book value of zero at the end of 10 years. NPV - 5 million (Enter only a WHOLE number rounded to the NEAREST MILLION. Enter a negative sign, if needed.] if cash flows were assumed to come at the END of the period, percent (Enter a number rounded to ONE decimal place.) NPV - S million (Enter only a WHOLE number rounded to the NEAREST MILLION. Enter a negative sign, if needed.) IRR = Blank 1: Blank 2: Blank 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts