Question: Show work! NOTE: FOR ALL PROBLEMS YOU MUST (as in MUST!) SHOW ALL WORK - if you just give an answer I will mark it

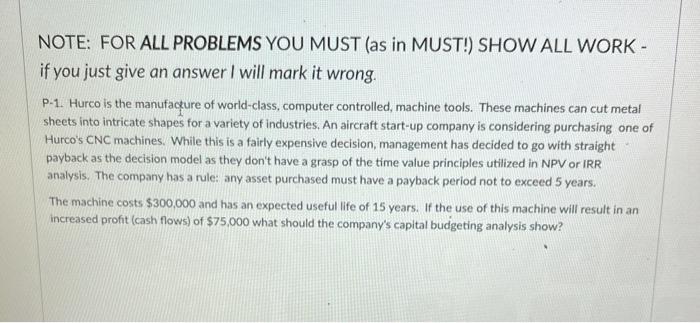

NOTE: FOR ALL PROBLEMS YOU MUST (as in MUST!) SHOW ALL WORK - if you just give an answer I will mark it wrong. P-1. Hurco is the manufacture of world-class, computer controlled, machine tools. These machines can cut metal sheets into intricate shapes for a variety of industries. An aircraft start-up company is considering purchasing one of Hurco's CNC machines. While this is a fairly expensive decision, management has decided to go with straight payback as the decision model as they don't have a grasp of the time value principles utilized in NPV or IRR analysis. The company has a rule: any asset purchased must have a payback period not to exceed 5 years. The machine costs $300,000 and has an expected useful life of 15 years. If the use of this machine will result in an increased profit (cash flows) of $75,000 what should the company's capital budgeting analysis show

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts