Question: show work please! 1. Which projects would you accept and why? Yes, I need to see some number crunching. 2. What would be their capital

1. Which projects would you accept and why? Yes, I need to see some "number crunching".

2. What would be their capital budget?

Part 2: Let's change one thing. The federal government has decided to increase the regulations affecting the manufacturing of chips. Complying with these new regulations will cost Acme $3 million, wiping out their retained earnings. So now:

1. Which project would you accept and why? More number crunching please!

2. What would be their capital budget now?

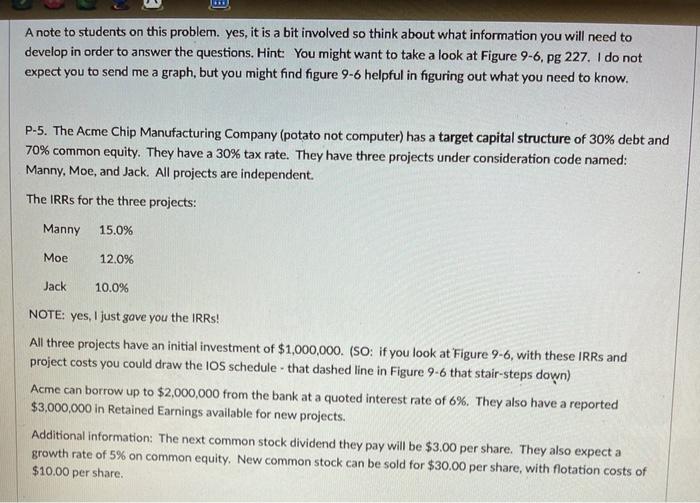

A note to students on this problem. yes, it is a bit involved so think about what information you will need to develop in order to answer the questions. Hint: You might want to take a look at Figure 9-6, pg 227. I do not expect you to send me a graph, but you might find figure 9-6 helpful in figuring out what you need to know. P-5. The Acme Chip Manufacturing Company (potato not computer) has a target capital structure of 30% debt and 70% common equity. They have a 30% tax rate. They have three projects under consideration code named: Manny, Moe, and Jack. All projects are independent. The IRRs for the three projects: Manny 15.0% Moe 12.0% Jack 10.0% NOTE: yes, I just gove you the IRRs! All three projects have an initial investment of $1,000,000. (SO: if you look at Figure 9-6, with these IRRs and project costs you could draw the IOS schedule - that dashed line in Figure 9-6 that stair-steps down) Acme can borrow up to $2,000,000 from the bank at a quoted interest rate of 6%. They also have a reported $3,000,000 in Retained Earnings available for new projects. Additional information: The next common stock dividend they pay will be $3.00 per share. They also expect a growth rate of 5% on common equity. New common stock can be sold for $30.00 per share, with flotation costs of $10.00 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts