Question: show work please 1. Your firm is a U.S.-based exporter. You have sold 1,000,000 worth of toys to an Italian firm. Payment from the Italian

show work please

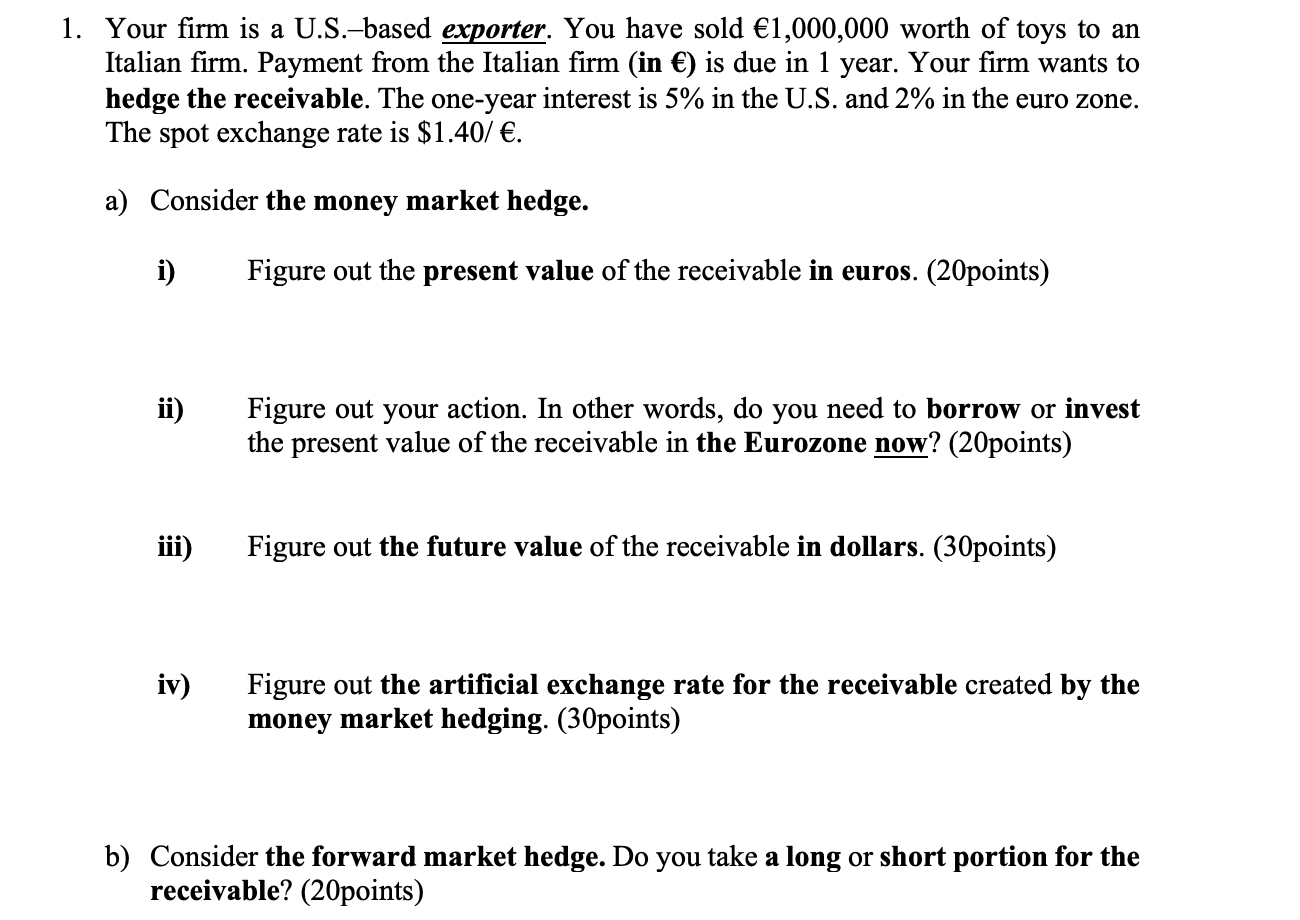

1. Your firm is a U.S.-based exporter. You have sold 1,000,000 worth of toys to an Italian firm. Payment from the Italian firm (in ) is due in 1 year. Your firm wants to hedge the receivable. The one-year interest is 5% in the U.S. and 2% in the euro zone. The spot exchange rate is $1.40/ . a) Consider the money market hedge. i) Figure out the present value of the receivable in euros. (20points) ii) Figure out your action. In other words, do you need to borrow or invest the present value of the receivable in the Eurozone now? (20points) iii) Figure out the future value of the receivable in dollars. (30points) iv) Figure out the artificial exchange rate for the receivable created by the money market hedging. (30points) b) Consider the forward market hedge. Do you take a long or short portion for the receivable? (20points) 1. Your firm is a U.S.-based exporter. You have sold 1,000,000 worth of toys to an Italian firm. Payment from the Italian firm (in ) is due in 1 year. Your firm wants to hedge the receivable. The one-year interest is 5% in the U.S. and 2% in the euro zone. The spot exchange rate is $1.40/ . a) Consider the money market hedge. i) Figure out the present value of the receivable in euros. (20points) ii) Figure out your action. In other words, do you need to borrow or invest the present value of the receivable in the Eurozone now? (20points) iii) Figure out the future value of the receivable in dollars. (30points) iv) Figure out the artificial exchange rate for the receivable created by the money market hedging. (30points) b) Consider the forward market hedge. Do you take a long or short portion for the receivable? (20points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts