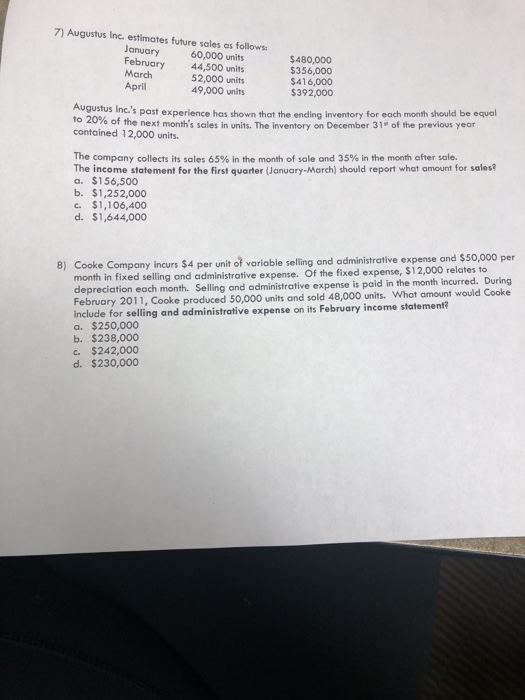

Question: Show work please 7) Augustus lnc. estimates future sales as follows January February 44,500 units March April 60,000 units 52,000 units 49,000 units 356,000 $416,000

Show work please

Show work please 7) Augustus lnc. estimates future sales as follows January February 44,500 units March April 60,000 units 52,000 units 49,000 units 356,000 $416,000 $392,000 ugustus Inc.'s past experience has shown that the ending inventory for each month should be equal to20% of the mo contained 12,000 units next month's sales in units. The inventory on December 31 of the previous year The company collects its sales 65% in the month of sale ond 35% in the month after sale. ihe income statement for the first quarter (January-March) should report what amount for sales? a. $156,500 b. $1,252,000 c $1,106,400 d. $1,644,000 e Company incurs $4 per unit of variable selling and administrative expense and s50,000 per month in fixed selling and administrative expense. Of the fixed expense, $12,000 relates to depreciation each month. Selling February 2011, Cooke produced 50,000 units and sold 48,000 units. What amount include for selling and administrative expense on its February income statement? a. $250,000 b. $238,000 c. $242,000 d. $230,000 and administrative expense is paid in the month incurred. During would Cooke

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts