Question: show work please A firm needs to take flotation costs into account when it is raising capital from issuing new common stock retained earnings Manning

show work please

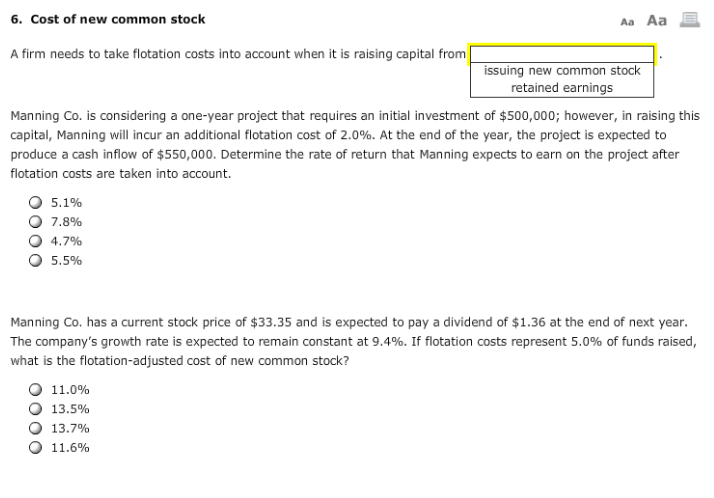

A firm needs to take flotation costs into account when it is raising capital from issuing new common stock retained earnings Manning Co. is considering a one-year project that requires an initial investment of $500,000; however, in raising this capital, Manning will incur an additional flotation cost of 2.0%. At the end of the year, the project is expected to produce a cash inflow of $550,000. Determine the rate of return that Manning expects to earn on the project after flotation costs are taken into account. Manning Co. has a current stock price of $33.35 and is expected to pay a dividend of $1.36 at the end of next year. The company's growth rate is expected to remain constant at 9.4%. If flotation costs represent 5.0% of funds raised, what is the flotation-adjusted cost of new common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts