Question: show work please B) During the current year a taxpayer incurs the following with respect to a vacation property The taxpayer uses the IRS allocation

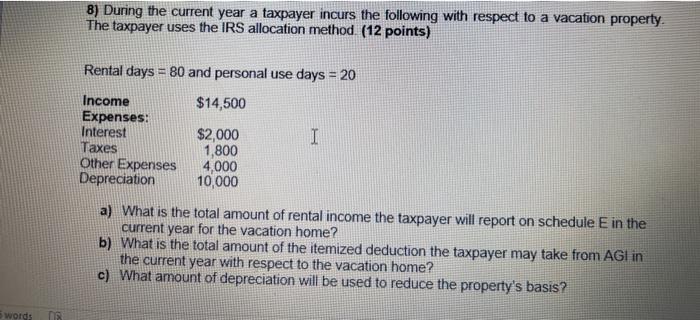

B) During the current year a taxpayer incurs the following with respect to a vacation property The taxpayer uses the IRS allocation method (12 points) Rental days = 80 and personal use days = 20 Income $14,500 Expenses: Interest $2,000 I Taxes 1,800 Other Expenses 4,000 Depreciation 10,000 a) What is the total amount of rental income the taxpayer will report on schedule E in the current year for the vacation home? b) What is the total amount of the itemized deduction the taxpayer may take from AG in the current year with respect to the vacation home? c) What amount of depreciation will be used to reduce the property's basis? words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts