Question: Show Work Please, explain the wrong answers on #3 3. Which of the following statements is correct? a. Bond A and Bond B are identical

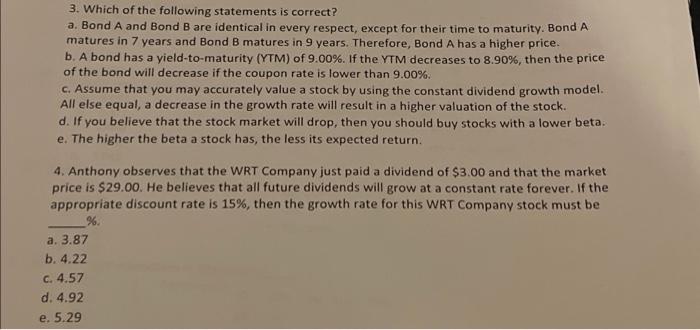

3. Which of the following statements is correct? a. Bond A and Bond B are identical in every respect, except for their time to maturity. Bond A matures in 7 years and Bond B matures in 9 years. Therefore, Bond A has a higher price. b. A bond has a yield-to-maturity (YTM) of 9.00%. If the YTM decreases to 8.90%, then the price of the bond will decrease if the coupon rate is lower than 9.00%. c. Assume that you may accurately value a stock by using the constant dividend growth model. All else equal, a decrease in the growth rate will result in a higher valuation of the stock. d. If you believe that the stock market will drop, then you should buy stocks with a lower beta. e. The higher the beta a stock has, the less its expected return. 4. Anthony observes that the WRT Company just paid a dividend of $3.00 and that the market price is $29.00. He believes that all future dividends will grow at a constant rate forever. If the appropriate discount rate is 15%, then the growth rate for this WRT Company stock must be % a. 3.87 b. 4.22 C. 4.57 d. 4.92 e. 5.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts