Question: show work please fast On September 1,2023 , the ABC Corporation purchased machinery for $130,000. The estimated service life of the machinery is 10 years

show work please fast

show work please fast

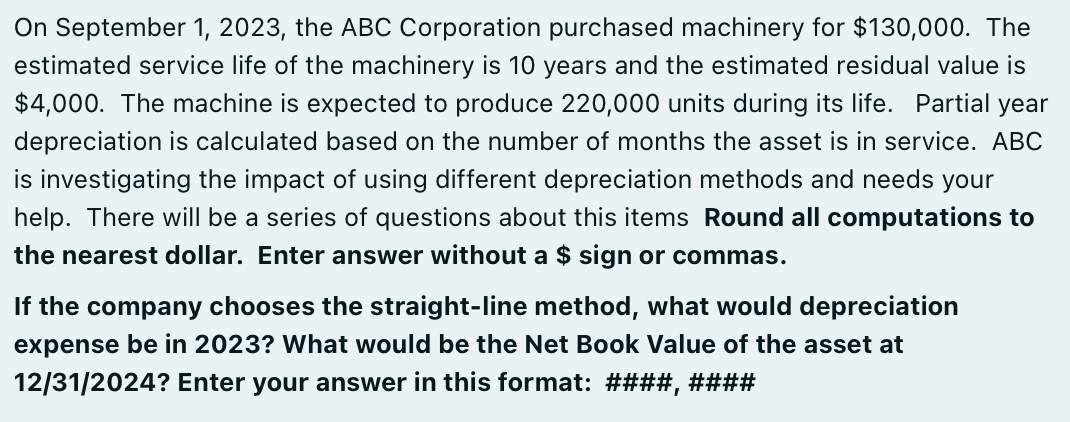

On September 1,2023 , the ABC Corporation purchased machinery for $130,000. The estimated service life of the machinery is 10 years and the estimated residual value is $4,000. The machine is expected to produce 220,000 units during its life. Partial year depreciation is calculated based on the number of months the asset is in service. ABC is investigating the impact of using different depreciation methods and needs your help. There will be a series of questions about this items Round all computations to the nearest dollar. Enter answer without a $ sign or commas. If the company chooses the straight-line method, what would depreciation expense be in 2023 ? What would be the Net Book Value of the asset at 12/31/2024? Enter your answer in this format: \#\#\#\#, \#\#\#\#

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts