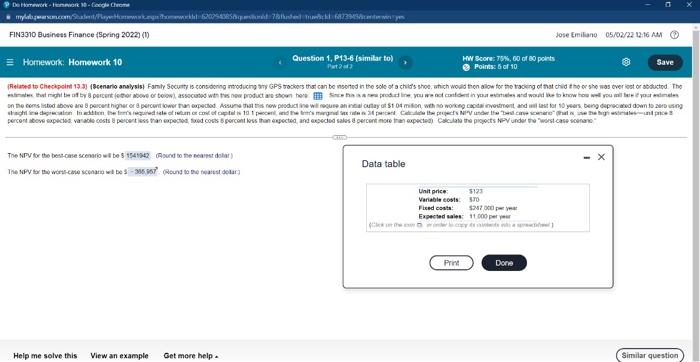

Question: show work please for worst case scenerio base case UNIT PRICE-$123 variable cost-$70 fixed cost-$247,000 per year expected sales- 11,000 per year 8% worst case

De Homework-tommor 10-Google Chrome mylabs.com/Stalent/PlayeHomework.homework-620294385878the rich 68229458-yes FIN3310 Business Finance (Spring 2022) (1) Jose Emiliano 05/02/22 12:16 AM Save Homework: Homework 10 Question 1, P13-6 (similar to) Part 22 HW Score: 75%, 00 of 80 points Points: 5 of 10 (Related to Checkpoint 13.3) (Scenario analysis) Family Security is considering introducing tiny GPS trackers that can be inserted in the sole of a child's shoe, which would then allow for the tracking of that child the or she was over lost or abducted The that might be off by 8 percent (other above or below), associated with this new product are shown herSince this is a new product line, you are not confident in your estimates and would like to know how well you will bere if your animales on the consisted above are 8 percent higher or 8 percent lower than expected. Assume that this new product line will require an initial cutay of $1 04 mision, with no working capital investment, and will last for 10 years, being deprecated down to zero using shaght is depreciation. In addition, the fe's required sale of return or cost of capital is 10.1 percent, and the tr's margind Sex 34 percent Call the projects NPV under the best case scanare that use the high astmalesunt pace percent above expected vanable costs & percent less than expected, fixed costs 8 percent less than expected, and expected sales 8 percent more than expected) Calculate the projects NPV under the worst case scena The NPV for the best-case scenario will be $1541942 Round to the east dolar) The NPV for the worst case scenario will be $385,957 (Round to the nearest dolar) Data table Unit price $123 $70 Variable costs Fixed costs $217,000 year Expected sales: 11.000 per year (cy) Print Done Help me solve this View an example Get more help. Similar question (Related to Checkpoint 13.3) (Scenario analysis) Fandy Security is considering inoducing tiny GPS backers hid can be merted in the son of a chi's show which would then allow for the t eshmates, that might be off by 6 percent other above or below) asciated with es new probat shown working cape w on the Rems inted above are & percent higher or 8 percent owe than expected. Assume that the new product kne w regi straight line depreciation In addition, the fem's required rate of rohu or cost of capital percent, and the fans percent above expected variable costs 6 percent less than expected food coses percent less than expected and expected sales pecent Calculate the picts NPV mon than expected Cate pros Ver t CHEED The NPV for the best-case scenario will be 51541942 Round to the case scenario bes-36595 het da) that child the or she was ever at of abad The are ad dzer using beng s Similar question sonra De Homework-tommor 10-Google Chrome mylabs.com/Stalent/PlayeHomework.homework-620294385878the rich 68229458-yes FIN3310 Business Finance (Spring 2022) (1) Jose Emiliano 05/02/22 12:16 AM Save Homework: Homework 10 Question 1, P13-6 (similar to) Part 22 HW Score: 75%, 00 of 80 points Points: 5 of 10 (Related to Checkpoint 13.3) (Scenario analysis) Family Security is considering introducing tiny GPS trackers that can be inserted in the sole of a child's shoe, which would then allow for the tracking of that child the or she was over lost or abducted The that might be off by 8 percent (other above or below), associated with this new product are shown herSince this is a new product line, you are not confident in your estimates and would like to know how well you will bere if your animales on the consisted above are 8 percent higher or 8 percent lower than expected. Assume that this new product line will require an initial cutay of $1 04 mision, with no working capital investment, and will last for 10 years, being deprecated down to zero using shaght is depreciation. In addition, the fe's required sale of return or cost of capital is 10.1 percent, and the tr's margind Sex 34 percent Call the projects NPV under the best case scanare that use the high astmalesunt pace percent above expected vanable costs & percent less than expected, fixed costs 8 percent less than expected, and expected sales 8 percent more than expected) Calculate the projects NPV under the worst case scena The NPV for the best-case scenario will be $1541942 Round to the east dolar) The NPV for the worst case scenario will be $385,957 (Round to the nearest dolar) Data table Unit price $123 $70 Variable costs Fixed costs $217,000 year Expected sales: 11.000 per year (cy) Print Done Help me solve this View an example Get more help. Similar question (Related to Checkpoint 13.3) (Scenario analysis) Fandy Security is considering inoducing tiny GPS backers hid can be merted in the son of a chi's show which would then allow for the t eshmates, that might be off by 6 percent other above or below) asciated with es new probat shown working cape w on the Rems inted above are & percent higher or 8 percent owe than expected. Assume that the new product kne w regi straight line depreciation In addition, the fem's required rate of rohu or cost of capital percent, and the fans percent above expected variable costs 6 percent less than expected food coses percent less than expected and expected sales pecent Calculate the picts NPV mon than expected Cate pros Ver t CHEED The NPV for the best-case scenario will be 51541942 Round to the case scenario bes-36595 het da) that child the or she was ever at of abad The are ad dzer using beng s Similar question sonra

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts