Question: Show work please Peter Stone is considering buying a $100 face value, semi-annual coupon bond with a quoted price of 105.19. His colleague points out

Show work please

Show work please

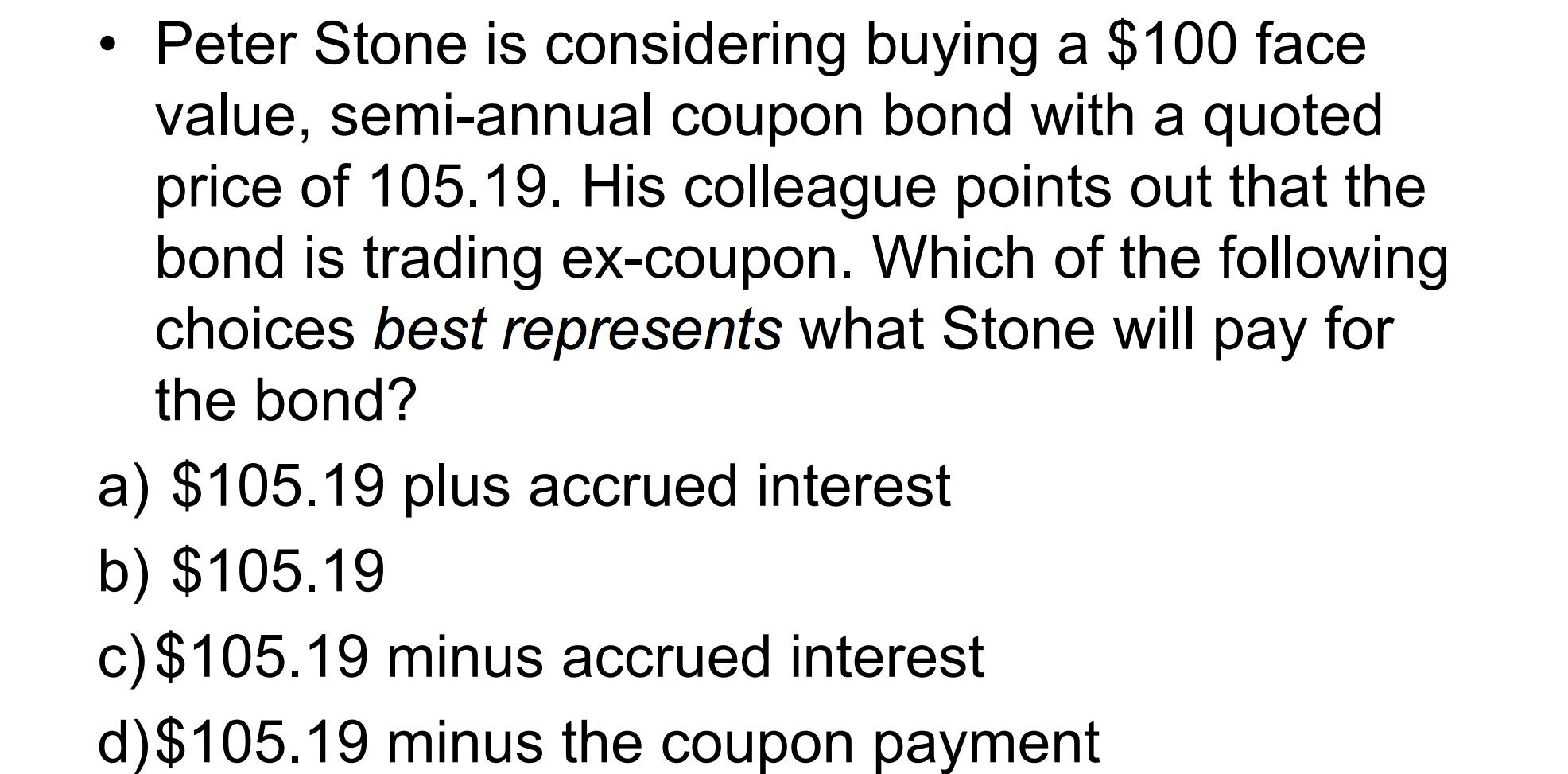

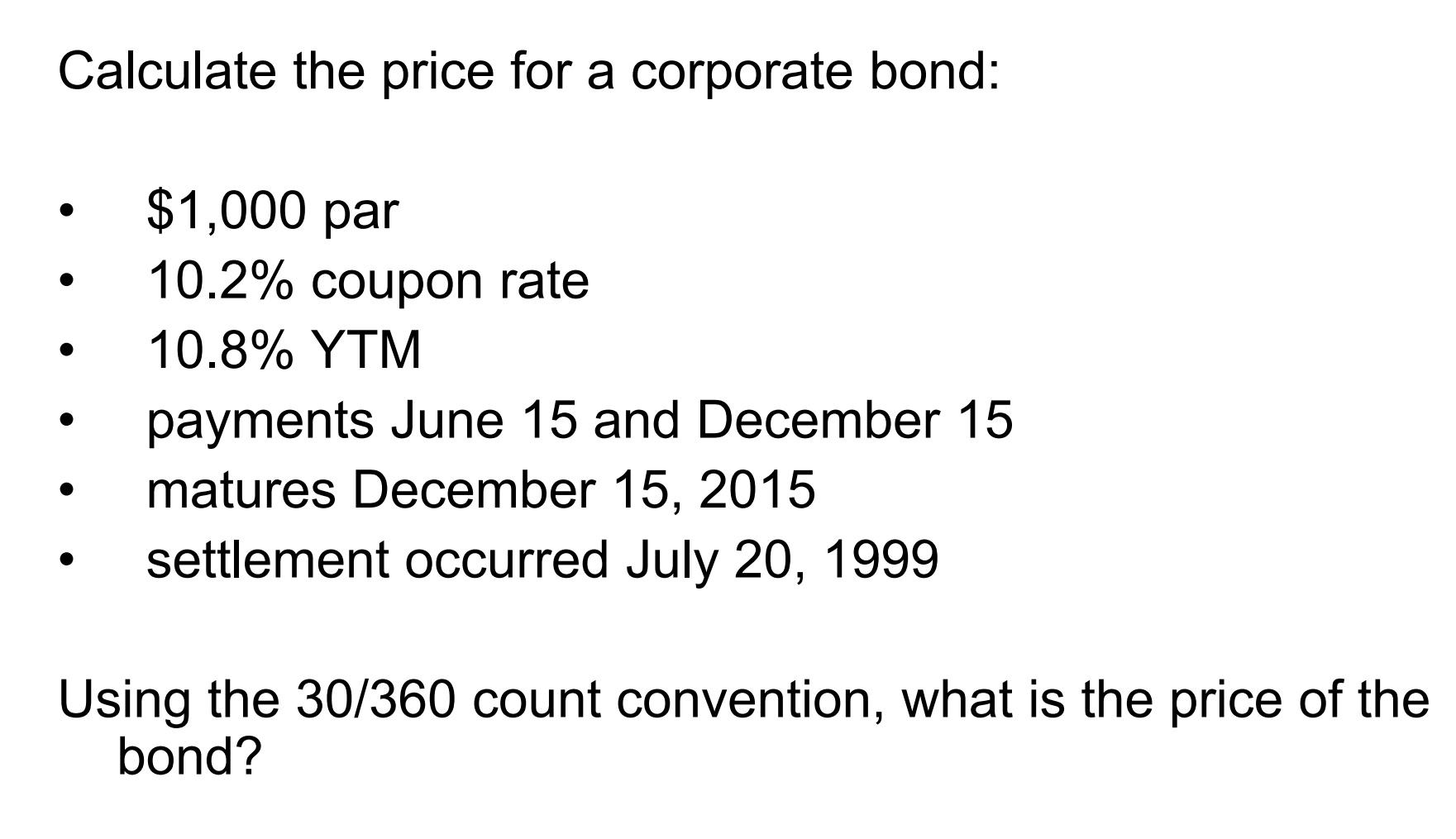

Peter Stone is considering buying a $100 face value, semi-annual coupon bond with a quoted price of 105.19. His colleague points out that the bond is trading ex-coupon. Which of the following choices best represents what Stone will pay for the bond? a) $105.19 plus accrued interest b) $105.19 c)$105.19 minus accrued interest d)$105.19 minus the coupon payment Calculate the price for a corporate bond: $1,000 par 10.2% coupon rate 10.8% YTM payments June 15 and December 15 matures December 15, 2015 settlement occurred July 20, 1999 Using the 30/360 count convention, what is the price of the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts