Question: show work please Problem 1 [14 points). On January 1, Han Solo loans Kylo Ren $90,000. The loan is to be repaid in years with

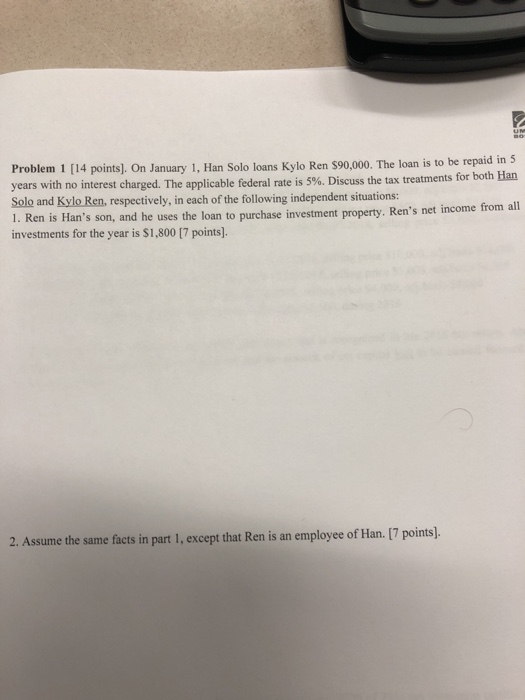

Problem 1 [14 points). On January 1, Han Solo loans Kylo Ren $90,000. The loan is to be repaid in years with no interest charged. The applicable federal rate is 5%. Discuss the tax treatments f Solo and Kylo Ren, respectively, in each of the following independent situations: 1. Ren is Han's son, and he uses the loan to purchase investm investments for the year is $1,800 [7 points] or both an ent property. Ren's net income from all 2. Assume the same facts in part I, except that Ren is an employee of Han. [7 points]. Problem 1 [14 points). On January 1, Han Solo loans Kylo Ren $90,000. The loan is to be repaid in years with no interest charged. The applicable federal rate is 5%. Discuss the tax treatments f Solo and Kylo Ren, respectively, in each of the following independent situations: 1. Ren is Han's son, and he uses the loan to purchase investm investments for the year is $1,800 [7 points] or both an ent property. Ren's net income from all 2. Assume the same facts in part I, except that Ren is an employee of Han. [7 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts