Question: show work please Problem 1: Presented below is information related to equipment owned by Crypto Mining Company as of December 31, 2020. Cost $5,600,000 Accumulated

show work please

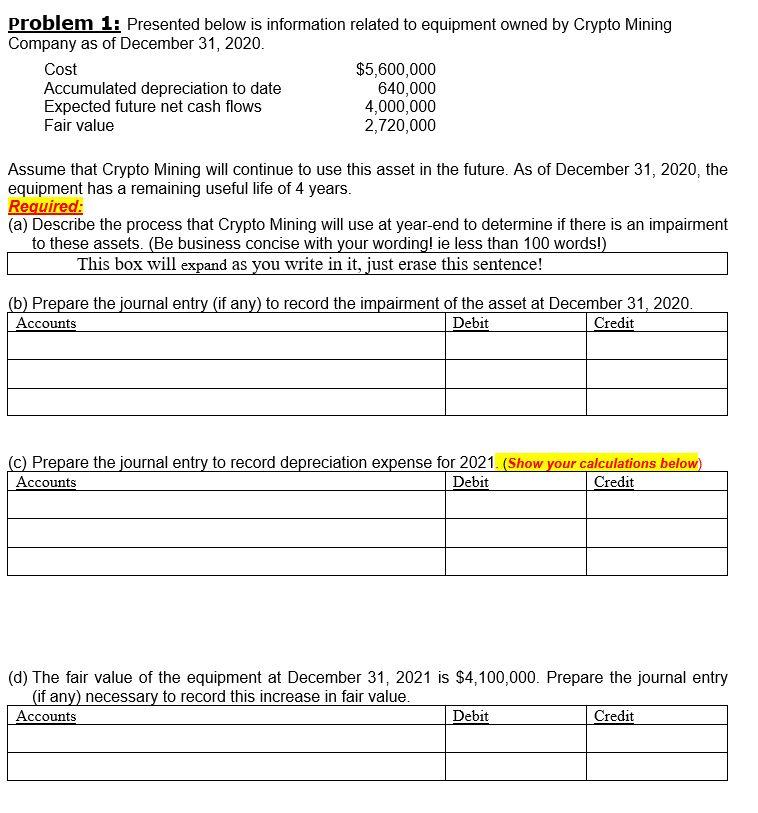

Problem 1: Presented below is information related to equipment owned by Crypto Mining Company as of December 31, 2020. Cost $5,600,000 Accumulated depreciation to date 640,000 Expected future net cash flows 4,000,000 Fair value 2,720,000 Assume that Crypto Mining will continue to use this asset in the future. As of December 31, 2020, the equipment has a remaining useful life of 4 years. Required: (a) Describe the process that Crypto Mining will use at year-end to determine if there is an impairment to these assets. (Be business concise with your wording! ie less than 100 words!) This box will expand as you write in it, just erase this sentence! (b) Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2020. Accounts Debit Credit (C) Prepare the journal entry to record depreciation expense for 2021. (Show your calculations below) Accounts Debit Credit (d) The fair value of the equipment at December 31, 2021 is $4,100,000. Prepare the journal entry (if any) necessary to record this increase in fair value. Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts