Question: show work Question 10 A borrower takes-out a partially amortizing loan in the amount of $200,000 for 20 years at 6% APR, compounded monthly. A

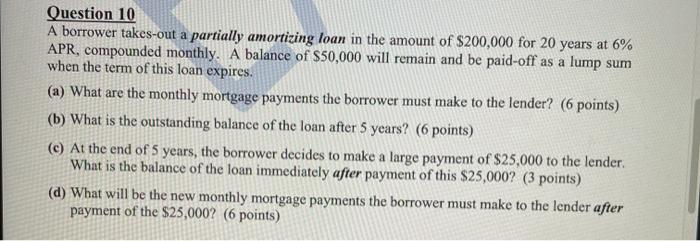

Question 10 A borrower takes-out a partially amortizing loan in the amount of $200,000 for 20 years at 6% APR, compounded monthly. A balance of $50,000 will remain and be paid-off as a lump sum when the term of this loan expires. (a) What are the monthly mortgage payments the borrower must make to the lender? (6 points) (b) What is the outstanding balance of the loan after 5 years? (6 points) (c) At the end of 5 years, the borrower decides to make a large payment of $25,000 to the lender What is the balance of the loan immediately after payment of this $25,000? (3 points) (d) What will be the new monthly mortgage payments the borrower must make to the lender after payment of the $25,000? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts