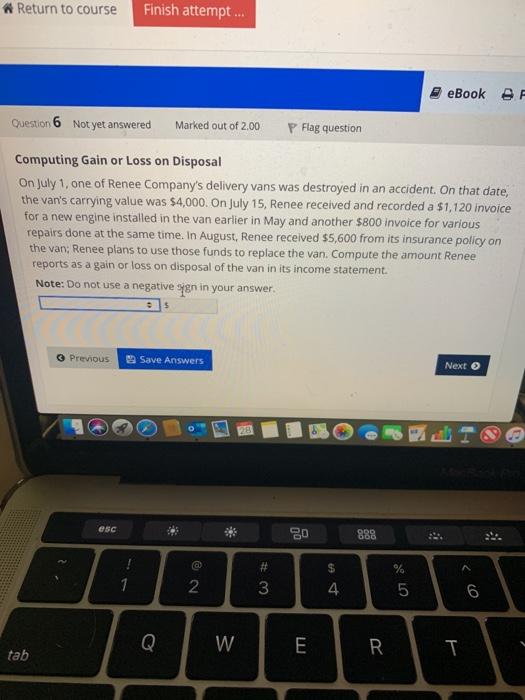

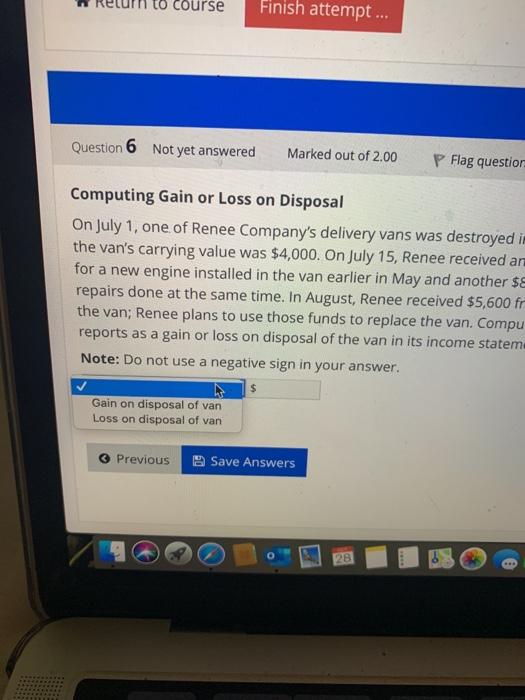

Question: show work Return to course Finish attempt... eBook E Question 6 Not yet answered Marked out of 2.00 P Flag question Computing Gain or Loss

show work

show work

Return to course Finish attempt... eBook E Question 6 Not yet answered Marked out of 2.00 P Flag question Computing Gain or Loss on Disposal On July 1, one of Renee Company's delivery vans was destroyed in an accident. On that date, the van's carrying value was $4,000. On July 15, Renee received and recorded a $1,120 invoice for a new engine installed in the van earlier in May and another $800 invoice for various repairs done at the same time. In August, Renee received $5,600 from its insurance policy on the var: Renee plans to use those funds to replace the van. Compute the amount Renee reports as a gain or loss on disposal of the van in its income statement. Note: Do not use a negative sign in your answer. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts