Question: show work step by step 20. Beverly died during the current year. At the time of her death, her accrued salary and commissions totaled $3,000

show work step by step

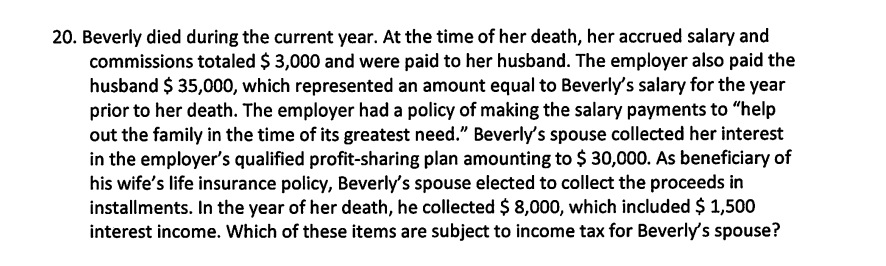

20. Beverly died during the current year. At the time of her death, her accrued salary and commissions totaled $3,000 and were paid to her husband. The employer also paid the husband $ 35,000, which represented an amount equal to Beverly's salary for the year prior to her death. The employer had a policy of making the salary payments to "help out the family in the time of its greatest need." Beverly's spouse collected her interest in the employer's qualified profit-sharing plan amounting to $ 30,000. As beneficiary of his wife's life insurance policy, Beverly's spouse elected to collect the proceeds in installments. In the year of her death, he collected $8,000, which included $ 1,500 interest income. Which of these items are subject to income tax for Beverly's spouse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts