Question: show work (: thank you 1- What is the value of a 10-year bond outstanding with 6 years left in year-to-maturity 5% annual coupon rate

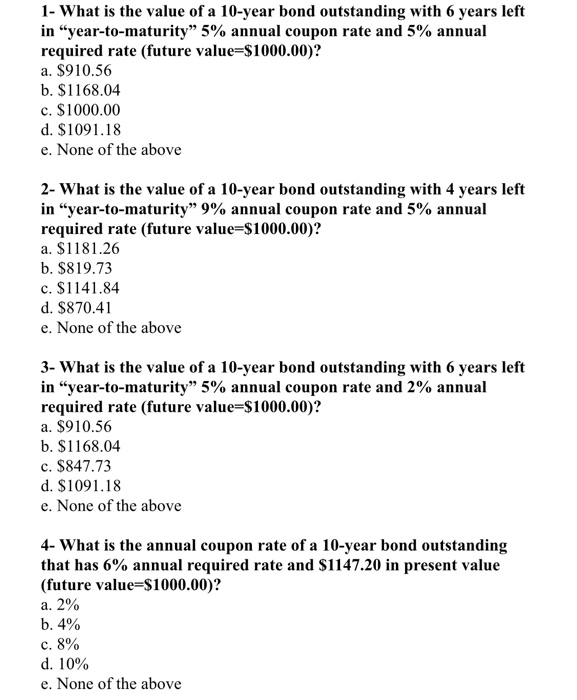

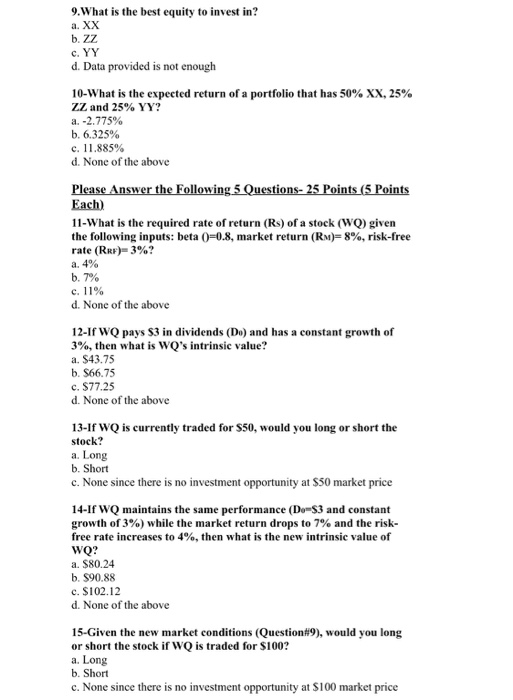

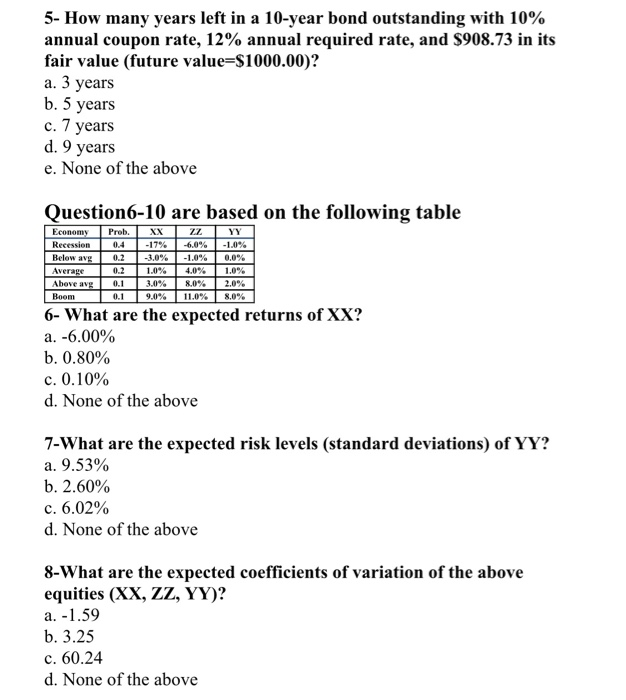

1- What is the value of a 10-year bond outstanding with 6 years left in "year-to-maturity" 5% annual coupon rate and 5% annual required rate (future value-$1000.00)? a. $910.56 b. $1168.04 c. $1000.00 d. $1091.18 e. None of the above 2- What is the value of a 10-year bond outstanding with 4 years left in "year-to-maturity" 9% annual coupon rate and 5% annual required rate (future value-$1000.00)? a. $1181.26 b. $819.73 c. $1141.84 d. $870.41 e. None of the above 3- What is the value of a 10-year bond outstanding with 6 years left in "year-to-maturity" 5% annual coupon rate and 2% annual required rate (future value-$1000.00)? a. $910.56 b. $1168.04 c. $847.73 d. $1091.18 e. None of the above 4- What is the annual coupon rate of a 10-year bond outstanding that has 6% annual required rate and $1147.20 in present value (future value-$1000.00)? a. 2% b. 4% c. 8% d. 10% e. None of the above 9.What is the best equity to invest in? .XX d. Data provided is not enough 10-What is the expected return of a portfolio that has 50% XX, 25% ZZ and 25% YY? a.-2.775% b. 6.325% . 11.885% d. None of the above Each) 11-What is the required rate of return (Rs) of a stock (WQ) given the following inputs: beta 0-08, market return (RM)-8%, risk-free rate (RRF)-3%? a. 490 b. 7% c.11% d. None of the above 12-If WQ pays S3 in dividends (Do) and has a constant growth of 390, then what is wors intrinsic value? a. $43.75 b. S66.75 c. $77.25 d. None of the above 13-If WQ is currently traded for S50, would you long or short the stock? a. Long b. Short c. None since there is no investment opportunity at $50 market price 14-If WQ maintains the same performance (Do- $3 and constant growth of 3%) while the market return drops to 7% and the risk- free rate increases to 4%, then what is the new intrinsic value of WQ? a. $80.24 b. $90.88 c. $102.12 d. None of the above 15-Given the new market conditions (Question#9), would you long or short the stock if WQ is traded for $100? a. Long b. Short c. None since there is no investment opportunity at $100 market price 5-How many years left in a 10-year bond outstanding with 10% annual coupon rate, 12% annual required rate, and $908.73 in its fair value (future value-$1000.00)? a. 3 years b. 5 years c. 7 years d. 9 years e. None of the above Question6-10 are based on the following table Prob. 0.4 XX 17% 3.0% -6.0% -1.0% 4.0 8.0% 11.0% Recessiorn Below a -1.0% 0.0% Above av 3.0% 9.0% 2.0% 8.0% Boom 0.1 6- What are the expected returns of XX? a.-6.00% b. 0.80% c. 0.10% d. None of the above 7-What are the expected risk levels (standard deviations) of YY? a. 9.53% b, 2.60% C. 6.02% d. None of the above 8-What are the expected coefficients of variation of the above equities (XX, ZZ, YY)? a. 1.59 b. 3.25 c. 60.24 d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts