Question: Show work Use the data provided below to answer the questions. Place your final answers in the provided cells (shaded green). If necessary, show your

Show work

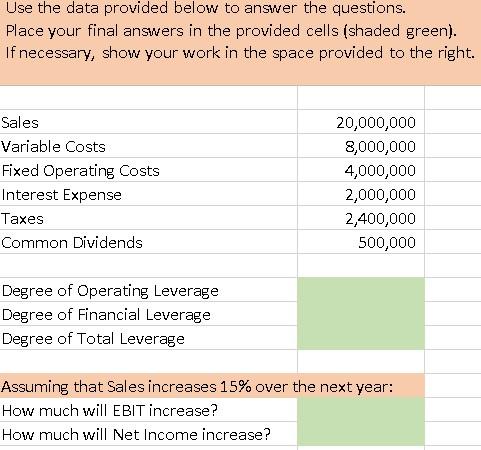

Use the data provided below to answer the questions. Place your final answers in the provided cells (shaded green). If necessary, show your work in the space provided to the right. Sales Variable Costs Fixed Operating Costs Interest Expense Taxes Common Dividends 20,000,000 8,000,000 4,000,000 2,000,000 2,400,000 500,000 Degree of Operating Leverage Degree of Financial Leverage Degree of Total Leverage Assuming that Sales increases 15% over the next year: How much will EBIT increase? How much will Net Income increase? Use the data provided below to answer the questions. Place your final answers in the provided cells (shaded green). If necessary, show your work in the space provided to the right. Sales Variable Costs Fixed Operating Costs Interest Expense Taxes Common Dividends 20,000,000 8,000,000 4,000,000 2,000,000 2,400,000 500,000 Degree of Operating Leverage Degree of Financial Leverage Degree of Total Leverage Assuming that Sales increases 15% over the next year: How much will EBIT increase? How much will Net Income increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts