Question: show work using Variable growth equation Example(4):Variable Growth Model - Let's assume that dividends will grow at a variable rate for the first three years

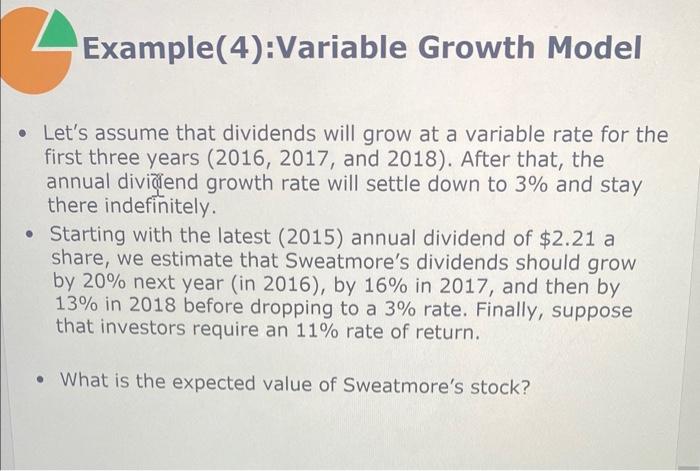

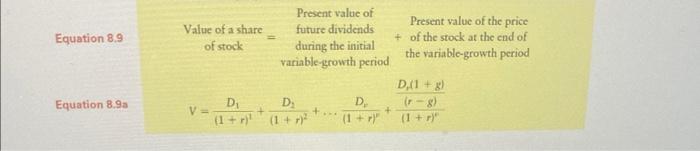

Example(4):Variable Growth Model - Let's assume that dividends will grow at a variable rate for the first three years (2016,2017, and 2018). After that, the annual diviciend growth rate will settle down to 3% and stay there indefinitely. - Starting with the latest (2015) annual dividend of \$2.21 a share, we estimate that Sweatmore's dividends should grow by 20% next year (in 2016), by 16% in 2017 , and then by 13% in 2018 before dropping to a 3% rate. Finally, suppose that investors require an 11% rate of return. - What is the expected value of Sweatmore's stock? Equation 8.9 Value of a share of stock Equation 8.9 a V=(1+r)2D1+(1+r)2D2+(1+r)2Df+(1+r)2(rg)D1(1+g)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts