Question: show work with financial calulator or normal calculator Eugene ZEM, the owner of HighPoint Silver Mining, is evaluating a new silver mine in Texas. John

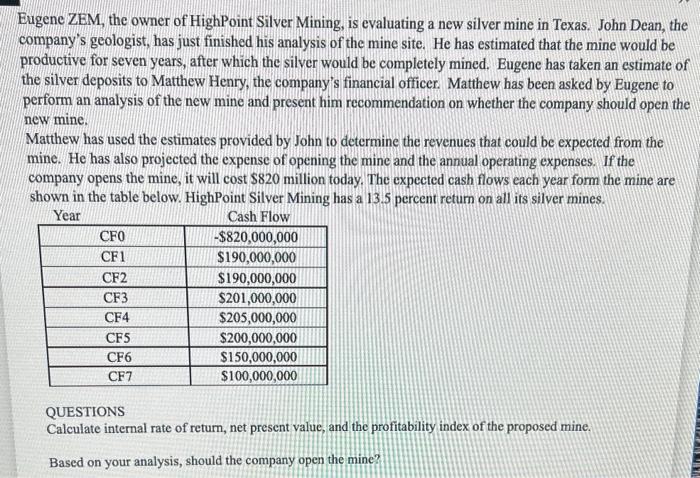

Eugene ZEM, the owner of HighPoint Silver Mining, is evaluating a new silver mine in Texas. John Dean, the company's geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for seven years, after which the silver would be completely mined. Eugene has taken an estimate of the silver deposits to Matthew Henry, the company's financial officer. Matthew has been asked by Bugene to perform an analysis of the new mine and present him recommendation on whether the company should open the new mine. Matthew has used the estimates provided by John to determine the revenues that could be expected from the mine. He has also projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $820 million today. The expected cash flows each year form the mine are shown in the table below. HighPoint Silver Mining has a 13.5 percent return on all its silver mines. QUESTIONS Calculate internal rate of return, net present value, and the profitability index of the proposed mine. Based on your analysis, should the company open the mine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts