Question: Show work/formulas in excel. Question 4. (5 Points) You have $100,000 that you are looking to invest in bonds and the yield curve is currently

Show work/formulas in excel.

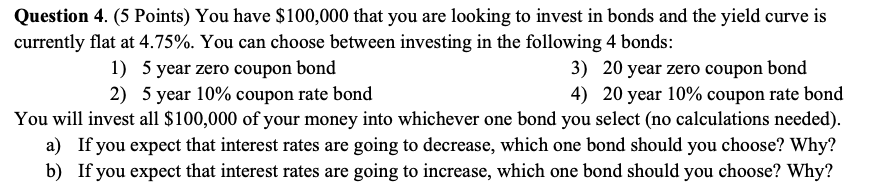

Question 4. (5 Points) You have $100,000 that you are looking to invest in bonds and the yield curve is currently flat at 4.75%. You can choose between investing in the following 4 bonds: 1) 5 year zero coupon bond 3) 20 year zero coupon bond 2) 5 year 10% coupon rate bond 4) 20 year 10% coupon rate bond You will invest all $100,000 of your money into whichever one bond you select (no calculations needed). a) If you expect that interest rates are going to decrease, which one bond should you choose? Why? b) If you expect that interest rates are going to increase, which one bond should you choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts