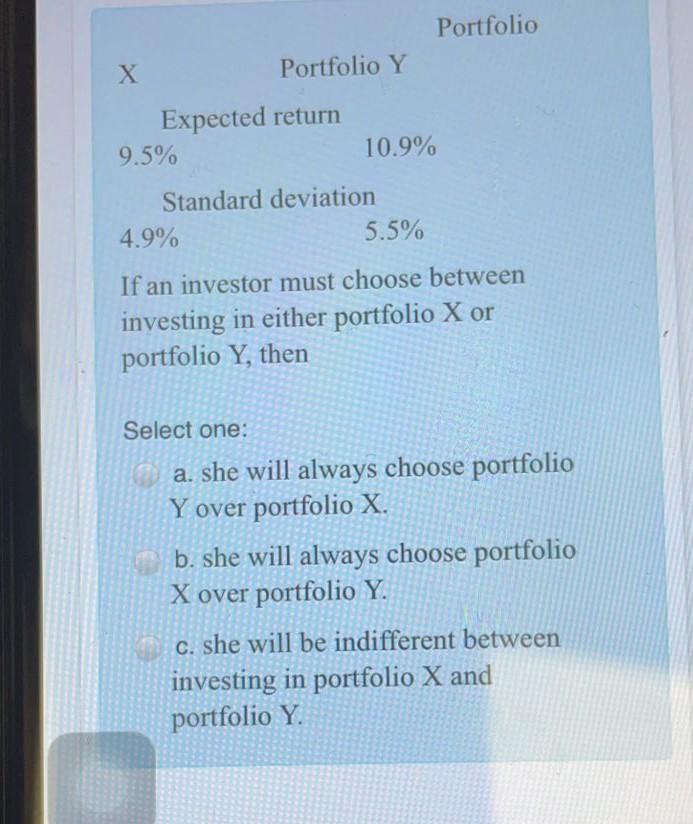

Question: show working and answer ASAP Portfolio Portfolio Y Expected return 9.5% 10.9% Standard deviation 4.9% 5.5% If an investor must choose between investing in either

show working and answer ASAP

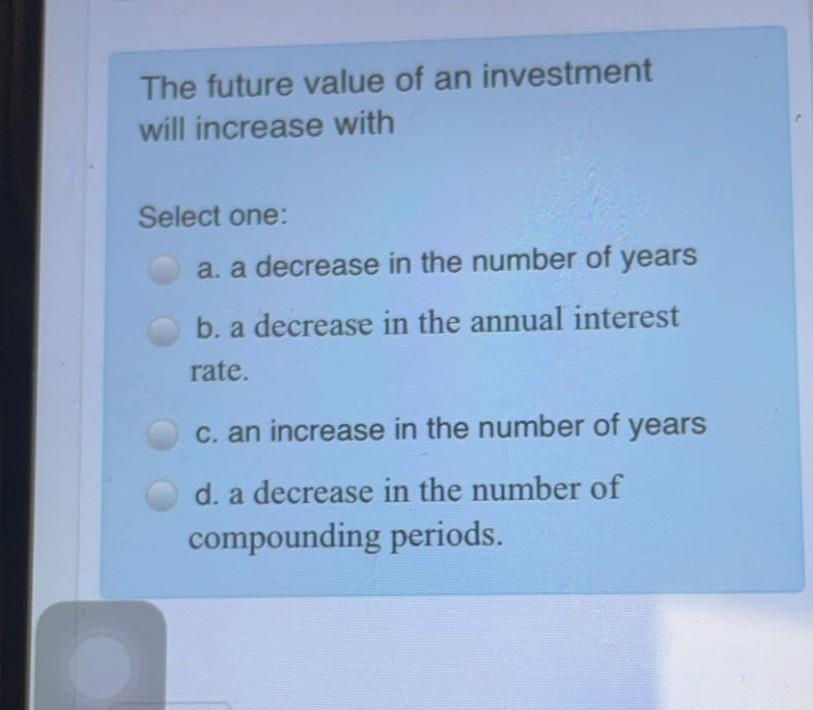

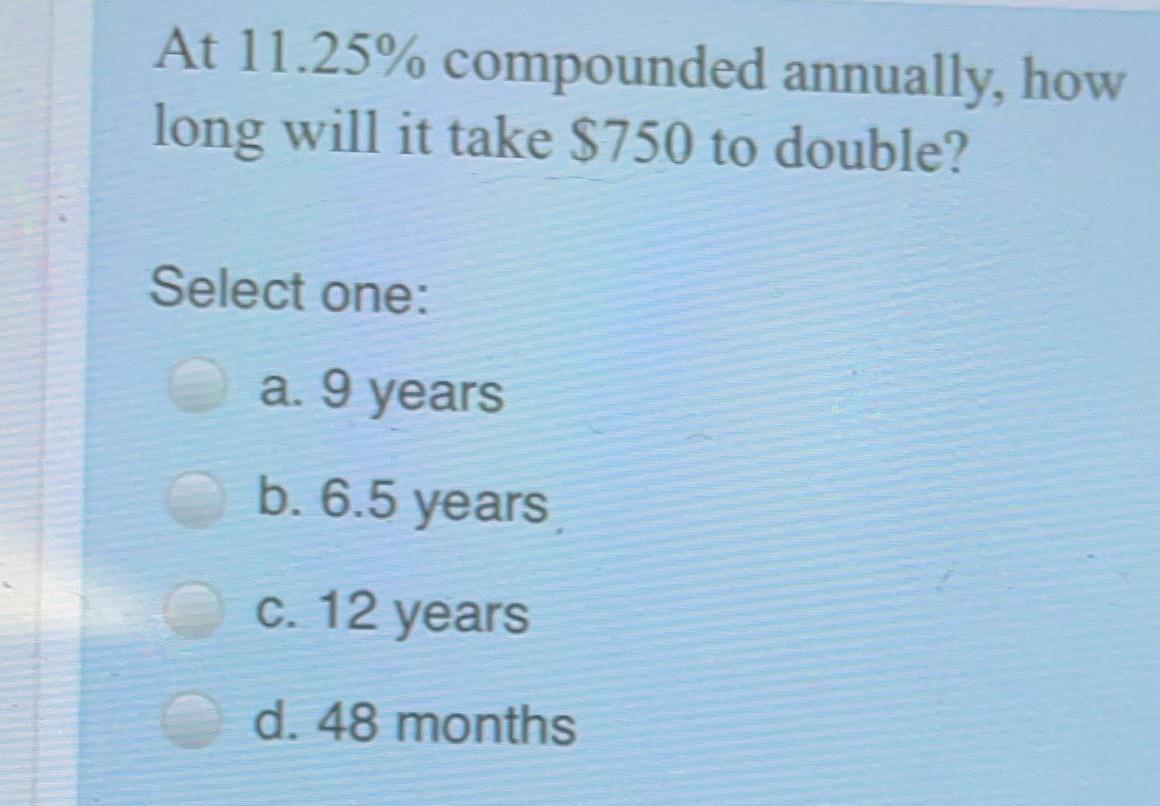

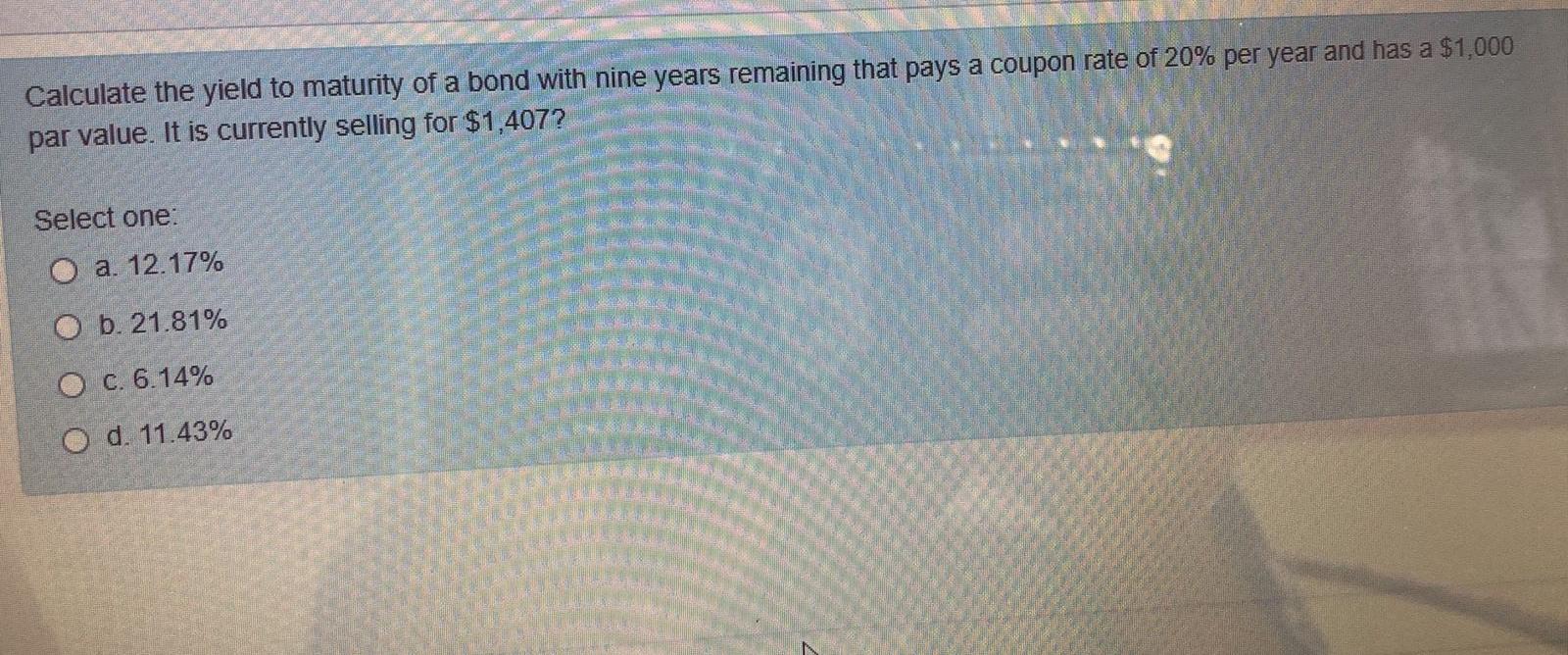

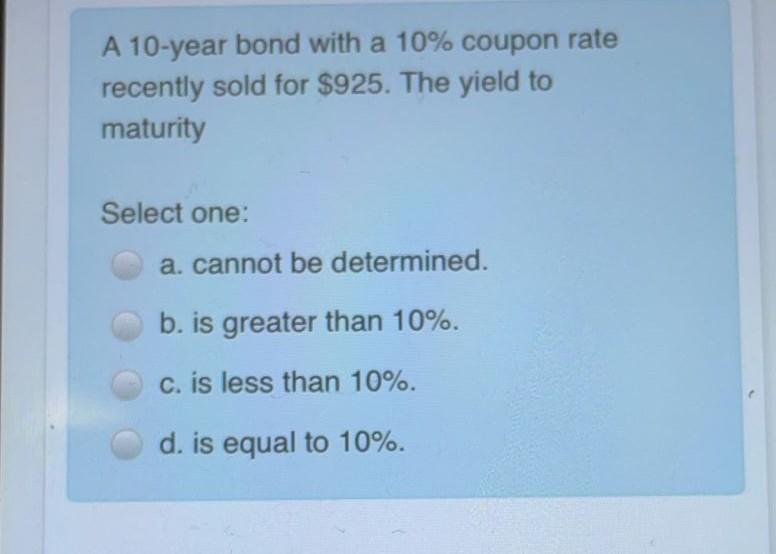

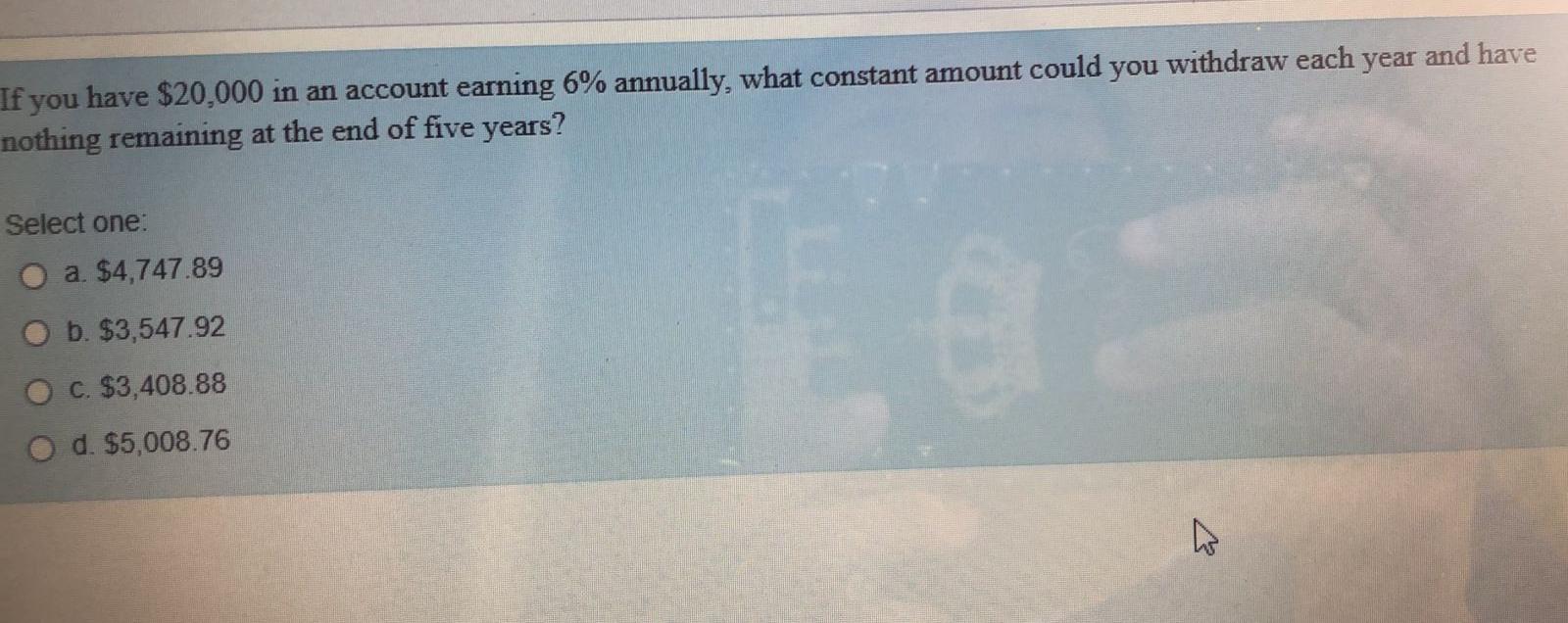

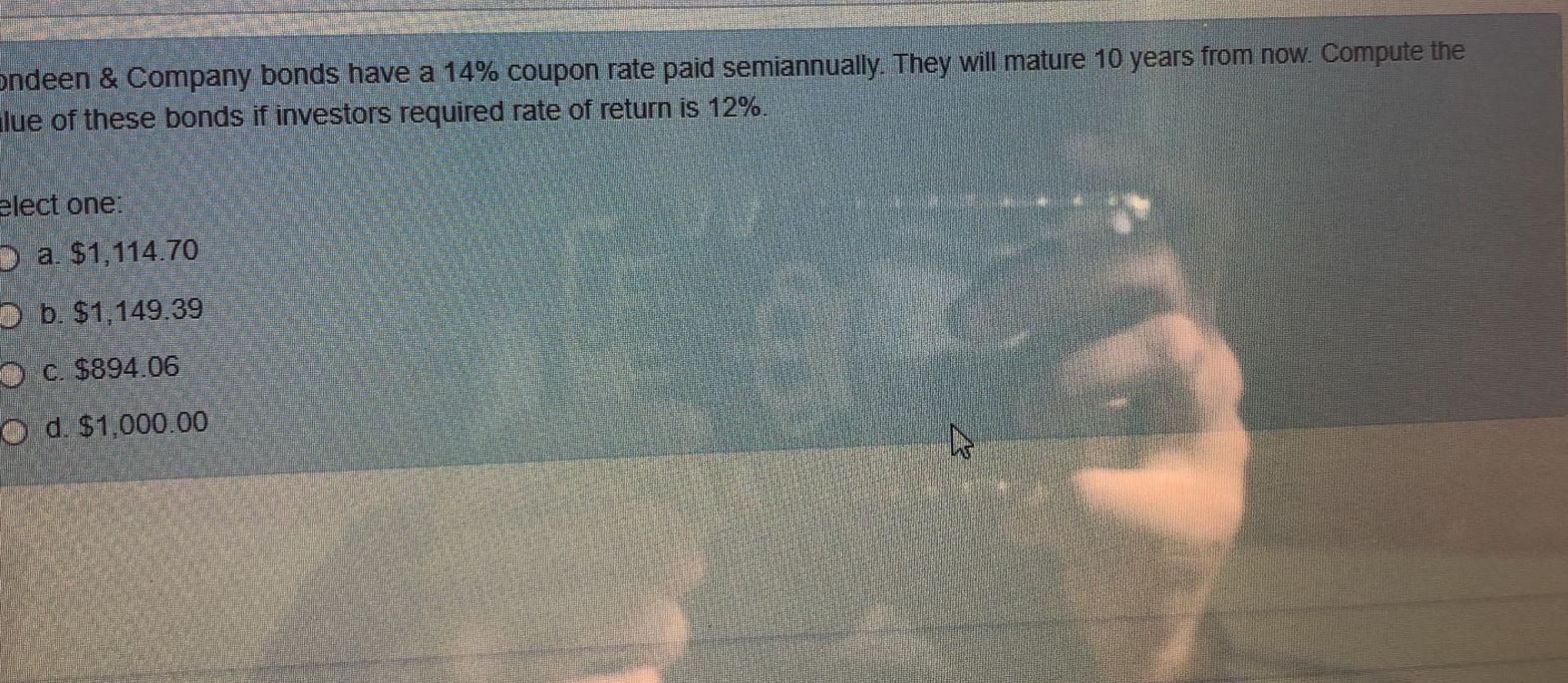

Portfolio Portfolio Y Expected return 9.5% 10.9% Standard deviation 4.9% 5.5% If an investor must choose between investing in either portfolio X or portfolio Y, then Select one: a. she will always choose portfolio Y over portfolio X. b. she will always choose portfolio X over portfolio Y. c. she will be indifferent between investing in portfolio X and portfolio Y. The future value of an investment will increase with Select one: a. a decrease in the number of years b. a decrease in the annual interest rate. c. an increase in the number of years d. a decrease in the number of compounding periods. At 11.25% compounded annually, how long will it take $750 to double? Select one: a. 9 years b. 6.5 years c. 12 years d. 48 months Calculate the yield to maturity of a bond with nine years remaining that pays a coupon rate of 20% per year and has a $1,000 par value. It is currently selling for $1,407? Select one: O a. 12.17% O b. 21.81% O C. 6.14% O d. 11.43% A 10-year bond with a 10% coupon rate recently sold for $925. The yield to maturity Select one: a. cannot be determined. b. is greater than 10%. c. is less than 10%. d. is equal to 10%. If you have $20,000 in an account earning 6% annually, what constant amount could you withdraw each year and have nothing remaining at the end of five years? Select one: O a $4,747.89 O b. $3,547.92 C. $3,408.88 O d. $5,008.76 ondeen & Company bonds have a 14% coupon rate paid semiannually. They will mature 10 years from now. Compute the Elue of these bonds if investors required rate of return is 12%. elect one: a. $1,114.70 b. $1,149.39 c. $894.06 O d. $1,000.00 a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts