Question: show working out how to get the answer Question 26 Johnson Ltd enters into a lease agreement with Peterson Ltd under the following conditions: Duration

show working out how to get the answer

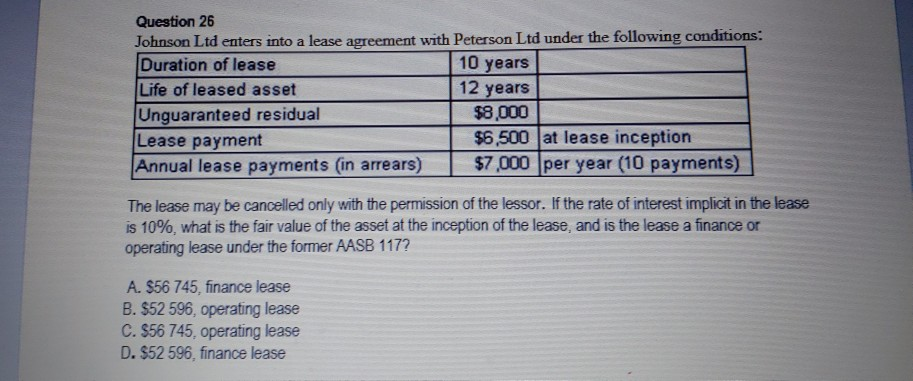

Question 26 Johnson Ltd enters into a lease agreement with Peterson Ltd under the following conditions: Duration of lease 10 years Life of leased asset 12 years Unguaranteed residual $8,000 Lease payment $6,500 at lease inception Annual lease payments (in arrears) $7,000 per year (10 payments) The lease may be cancelled only with the permission of the lessor. If the rate of interest implicit in the lease is 10%, what is the fair value of the asset at the inception of the lease, and is the lease a finance or operating lease under the former AASB 117? A. $56 745, finance lease B. $52 596, operating lease C. $56 745, operating lease D. $52 596, finance lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts