Question: Show written work please! Marge's Campground is considering adding a miniature golf course to its facility. The course she wants would cost $30,000, would be

Show written work please!

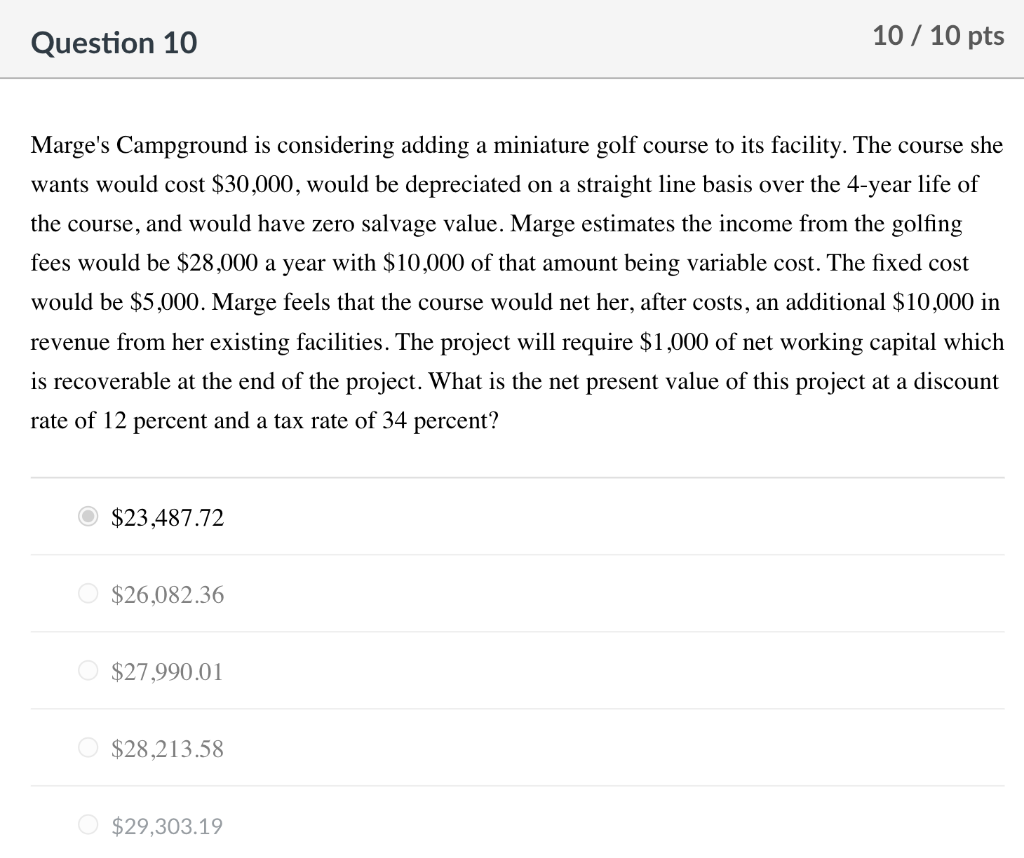

Marge's Campground is considering adding a miniature golf course to its facility. The course she wants would cost $30,000, would be depreciated on a straight line basis over the 4-year life of the course, and would have zero salvage value. Marge estimates the income from the golfing fees would be $28,000 a year with $10,000 of that amount being variable cost. The fixed cost would be $5,000. Marge feels that the course would net her, after costs, an additional $10,000 in revenue from her existing facilities. The project will require $1,000 of net working capital which is recoverable at the end of the project. What is the net present value of this project at a discount rate of 12 percent and a tax rate of 34 percent? $23,487.72 $26,082.36 $27,990.01 $28,213.58 $29,303.19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts