Question: Show your calculation please. Fish Tank Bhd has been involved in the business of designing and providing high technology systems for home aquarium. The following

Show your calculation please.

Show your calculation please.

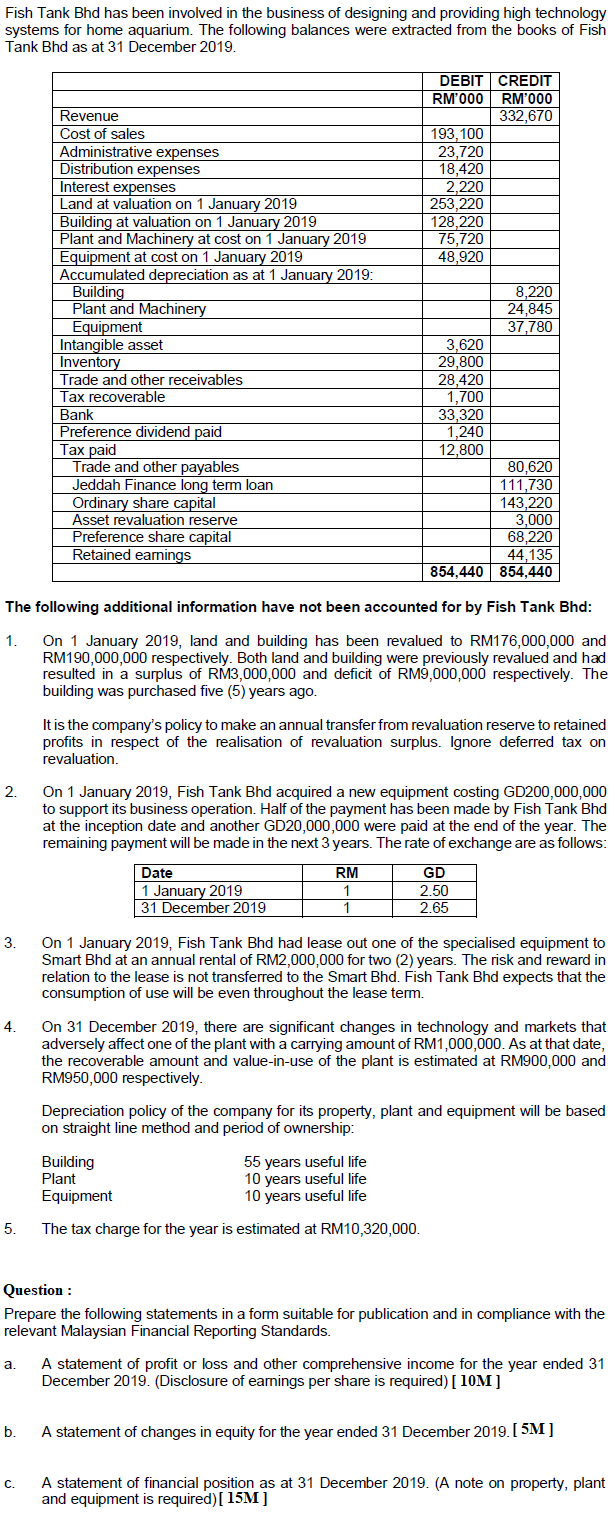

Fish Tank Bhd has been involved in the business of designing and providing high technology systems for home aquarium. The following balances were extracted from the books of Fish Tank Bhd as at 31 December 2019. DEBIT CREDIT RM'000 RM'000 332,670 193, 100 23,720 18,420 2,220 253,220 128,220 75,720 48,920 Revenue Cost of sales Administrative expenses Distribution expenses Interest expenses Land at valuation on 1 January 2019 Building at valuation on 1 January 2019 Plant and Machinery at cost on 1 January 2019 Equipment at cost on 1 January 2019 Accumulated depreciation as at 1 January 2019: Building Plant and Machinery Equipment Intangible asset Inventory | Trade and other receivables Tax recoverable Bank Preference dividend paid Tax paid Trade and other payables Jeddah Finance long term loan Ordinary share capital Asset revaluation reserve Preference share capital Retained earnings 8,220 24.845 37,780 3,620 29,800 28.420 1,700 33,320 1,240 12,800 80.620 111,730 143,220 3,000 68.220 44,135 854,440 854,440 The following additional information have not been accounted for by Fish Tank Bhd: 1. On 1 January 2019, land and building has been revalued to RM176,000,000 and RM190,000,000 respectively. Both land and building were previously revalued and had resulted in a surplus of RM3,000,000 and deficit of RM9,000,000 respectively. The building was purchased five (5) years ago. It is the company's policy to make an annual transfer from revaluation reserve to retained profits in respect of the realisation of revaluation surplus. Ignore deferred tax on revaluation. 2. On 1 January 2019, Fish Tank Bhd acquired a new equipment costing GD200,000,000 to support its business operation. Half of the payment has been made by Fish Tank Bhd at the inception date and another GD20,000,000 were paid at the end of the year. The remaining payment will be made in the next 3 years. The rate of exchange are as follows: Date 1 January 2019 31 December 2019 RM 1 1 GD 2.50 2.65 3. On 1 January 2019, Fish Tank Bhd had lease out one of the specialised equipment to Smart Bhd at an annual rental of RM2,000,000 for two (2) years. The risk and reward in relation to the lease is not transferred to the Smart Bhd. Fish Tank Bhd expects that the consumption of use will be even throughout the lease term. 4. On 31 December 2019, there are significant changes in technology and markets that adversely affect one of the plant with a carrying amount of RM1,000,000. As at that date, the recoverable amount and value-in-use of the plant is estimated at RM900,000 and RM950,000 respectively. Depreciation policy of the company for its property, plant and equipment will be based on straight line method and period of ownership: Building 55 years useful life Plant 10 years useful life Equipment 10 years useful life 5. The tax charge for the year is estimated at RM10,320,000. Question : Prepare the following statements in a form suitable for publication and in compliance with the relevant Malaysian Financial Reporting Standards. a. A statement of profit or loss and other comprehensive income for the year ended 31 December 2019. (Disclosure of earnings per share is required) [10M] b. A statement of changes in equity for the year ended 31 December 2019. [ 5M] C. A statement of financial position as at 31 December 2019. (A note on property, plant and equipment is required) [ 15M] Fish Tank Bhd has been involved in the business of designing and providing high technology systems for home aquarium. The following balances were extracted from the books of Fish Tank Bhd as at 31 December 2019. DEBIT CREDIT RM'000 RM'000 332,670 193, 100 23,720 18,420 2,220 253,220 128,220 75,720 48,920 Revenue Cost of sales Administrative expenses Distribution expenses Interest expenses Land at valuation on 1 January 2019 Building at valuation on 1 January 2019 Plant and Machinery at cost on 1 January 2019 Equipment at cost on 1 January 2019 Accumulated depreciation as at 1 January 2019: Building Plant and Machinery Equipment Intangible asset Inventory | Trade and other receivables Tax recoverable Bank Preference dividend paid Tax paid Trade and other payables Jeddah Finance long term loan Ordinary share capital Asset revaluation reserve Preference share capital Retained earnings 8,220 24.845 37,780 3,620 29,800 28.420 1,700 33,320 1,240 12,800 80.620 111,730 143,220 3,000 68.220 44,135 854,440 854,440 The following additional information have not been accounted for by Fish Tank Bhd: 1. On 1 January 2019, land and building has been revalued to RM176,000,000 and RM190,000,000 respectively. Both land and building were previously revalued and had resulted in a surplus of RM3,000,000 and deficit of RM9,000,000 respectively. The building was purchased five (5) years ago. It is the company's policy to make an annual transfer from revaluation reserve to retained profits in respect of the realisation of revaluation surplus. Ignore deferred tax on revaluation. 2. On 1 January 2019, Fish Tank Bhd acquired a new equipment costing GD200,000,000 to support its business operation. Half of the payment has been made by Fish Tank Bhd at the inception date and another GD20,000,000 were paid at the end of the year. The remaining payment will be made in the next 3 years. The rate of exchange are as follows: Date 1 January 2019 31 December 2019 RM 1 1 GD 2.50 2.65 3. On 1 January 2019, Fish Tank Bhd had lease out one of the specialised equipment to Smart Bhd at an annual rental of RM2,000,000 for two (2) years. The risk and reward in relation to the lease is not transferred to the Smart Bhd. Fish Tank Bhd expects that the consumption of use will be even throughout the lease term. 4. On 31 December 2019, there are significant changes in technology and markets that adversely affect one of the plant with a carrying amount of RM1,000,000. As at that date, the recoverable amount and value-in-use of the plant is estimated at RM900,000 and RM950,000 respectively. Depreciation policy of the company for its property, plant and equipment will be based on straight line method and period of ownership: Building 55 years useful life Plant 10 years useful life Equipment 10 years useful life 5. The tax charge for the year is estimated at RM10,320,000. Question : Prepare the following statements in a form suitable for publication and in compliance with the relevant Malaysian Financial Reporting Standards. a. A statement of profit or loss and other comprehensive income for the year ended 31 December 2019. (Disclosure of earnings per share is required) [10M] b. A statement of changes in equity for the year ended 31 December 2019. [ 5M] C. A statement of financial position as at 31 December 2019. (A note on property, plant and equipment is required) [ 15M]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts