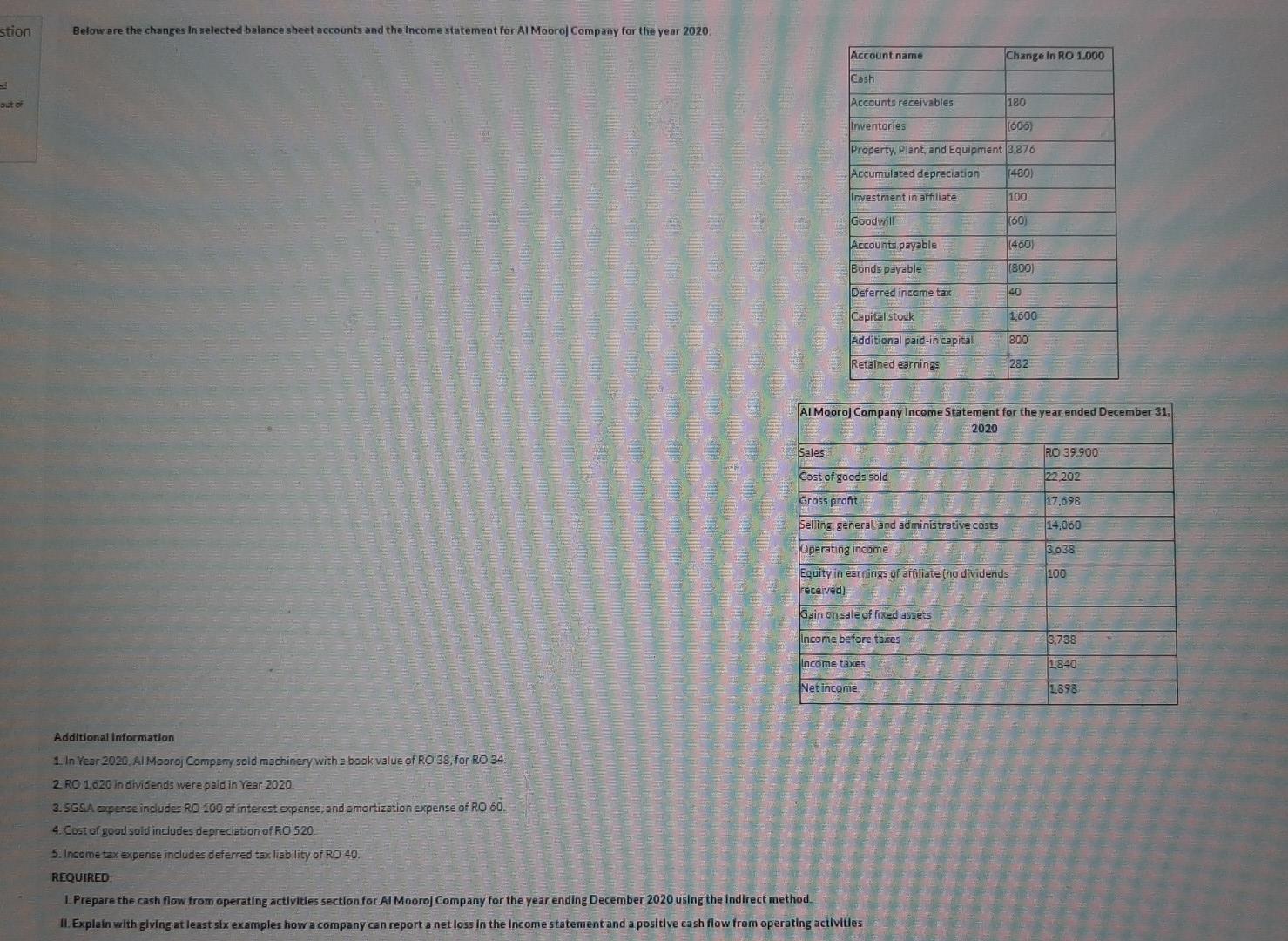

Question: show your calculation stion Below are the changes in selected balance sheet accounts and the income statement for Al Mooroj Company for the year 2020

show your calculation

stion Below are the changes in selected balance sheet accounts and the income statement for Al Mooroj Company for the year 2020 Account name Change in RO 1.000 Cash out of Accounts receivables 180 Inventories (606) Property. Plent, and Equipment 3.876 Accumulated depreciation (480) Investment in affiliate 100 Goodwill (60) Accounts payable (460) Bonds payable (800) Deferred income tax 40 Capital stock 1600 Additional paid-in capital 800 Retained earnings 1282 Al Mooroj Company Income Statement for the year ended December 31, 2020 Sales RC 39 900 22 202 27,698 14.000 Cost of goods sold Gross profit Selling, general and administrative COSES Operating income Equity in earnings of affiliate (no dividends received) 3038 100 Gain on sale of fixed assets Income before taxes 3.738 Income taxes 1840 Net income 1.898 Additional Information 1 In Year 2020. AIN Company sold with a book value of RO 38, for RO 34 2 RO 1,820 in dividends were paid in Year 2020 3. SGSA Spense includes RO 100 at interest expense and amortization expense of RO 60. 4. Cost of good sold includes depreciation of RO 520 5. Income tzx expense includes deferred taliability of RO 40. REQUIRED L Prepare the cash flow from operating activities section for Al Mooroj Company for the year ending December 2020 using the Indirect method. II. Explain with glving at least six examples how a company can report a net loss in the Income statement and a positive cash flow from operating activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts