Question: Show your formula and process Question 4 Suppose today is January 1, 2009. On January 1, 1999, MAM Industries issued a 30-year bond witha 9%

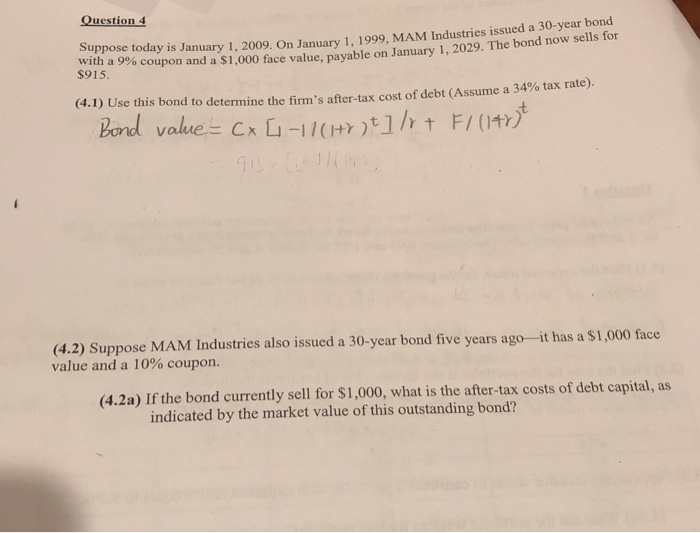

Question 4 Suppose today is January 1, 2009. On January 1, 1999, MAM Industries issued a 30-year bond witha 9% coupon and a $1,000 face value, payable on January 1, 202 $915 9. The bond now sells for (4.1) Use this bond to determine the firm's after-tax cost of debt (Assume a 34% tax rate). (4.2) Suppose MAM Industries also issued a 30-year bond five years ago-it has value and a 10% coupon. (4.2a) If the bond currently sell for $1,000, what is the after-tax costs of debt capital, as indicated by the market value of this outstanding bond? (4.2b) Suppose five years from now the MAM bond described in 4.2a has a market price of $1,100. What is the after-tax cost of debt capital at that time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts