Question: Show your steps clearly The question is given like that, solve clearly all steps should be shown. Question Four (Adapted from Kieso) At April 30,

Show your steps clearly

The question is given like that, solve clearly all steps should be shown.

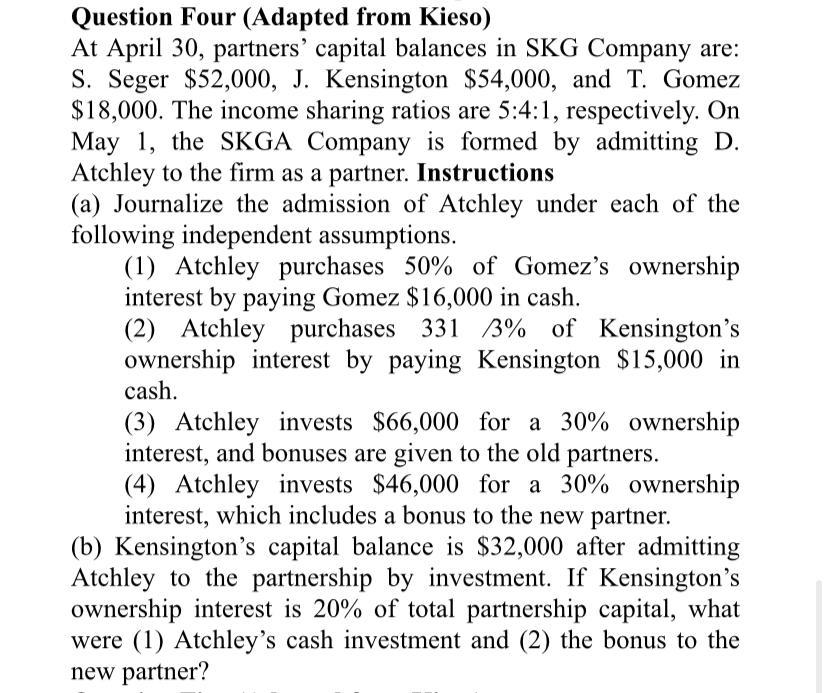

Question Four (Adapted from Kieso) At April 30, partners' capital balances in SKG Company are: S. Seger $52,000, J. Kensington $54,000, and T. Gomez $18,000. The income sharing ratios are 5:4:1, respectively. On May 1, the SKGA Company is formed by admitting D. Atchley to the firm as a partner. Instructions (a) Journalize the admission of Atchley under each of the following independent assumptions. (1) Atchley purchases 50% of Gomez's ownership interest by paying Gomez $16,000 in cash. (2) Atchley purchases 3313% of Kensington's ownership interest by paying Kensington $15,000 in cash. (3) Atchley invests $66,000 for a 30% ownership interest, and bonuses are given to the old partners. (4) Atchley invests $46,000 for a 30% ownership interest, which includes a bonus to the new partner. (b) Kensington's capital balance is $32,000 after admitting Atchley to the partnership by investment. If Kensington's ownership interest is 20% of total partnership capital, what were (1) Atchley's cash investment and (2) the bonus to the new partner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts