Question: show your work Bronson Industries reported a deferred tax liability of $14.5 million for the year ended December 31, 2020, related to a temporary difference

show your work

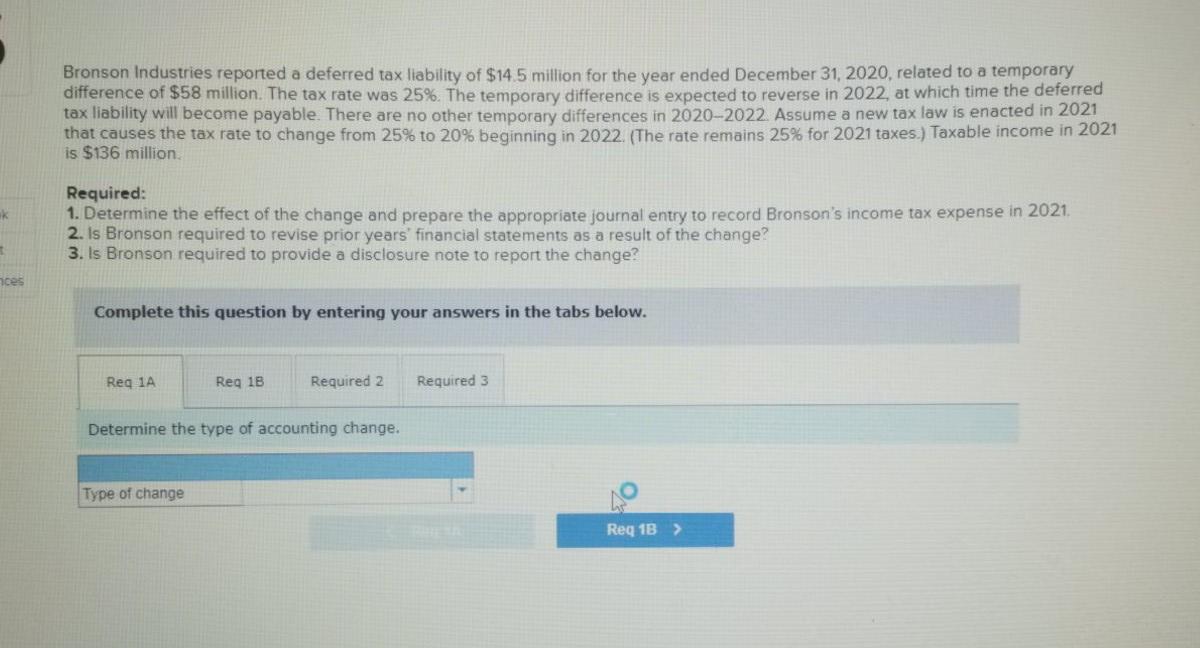

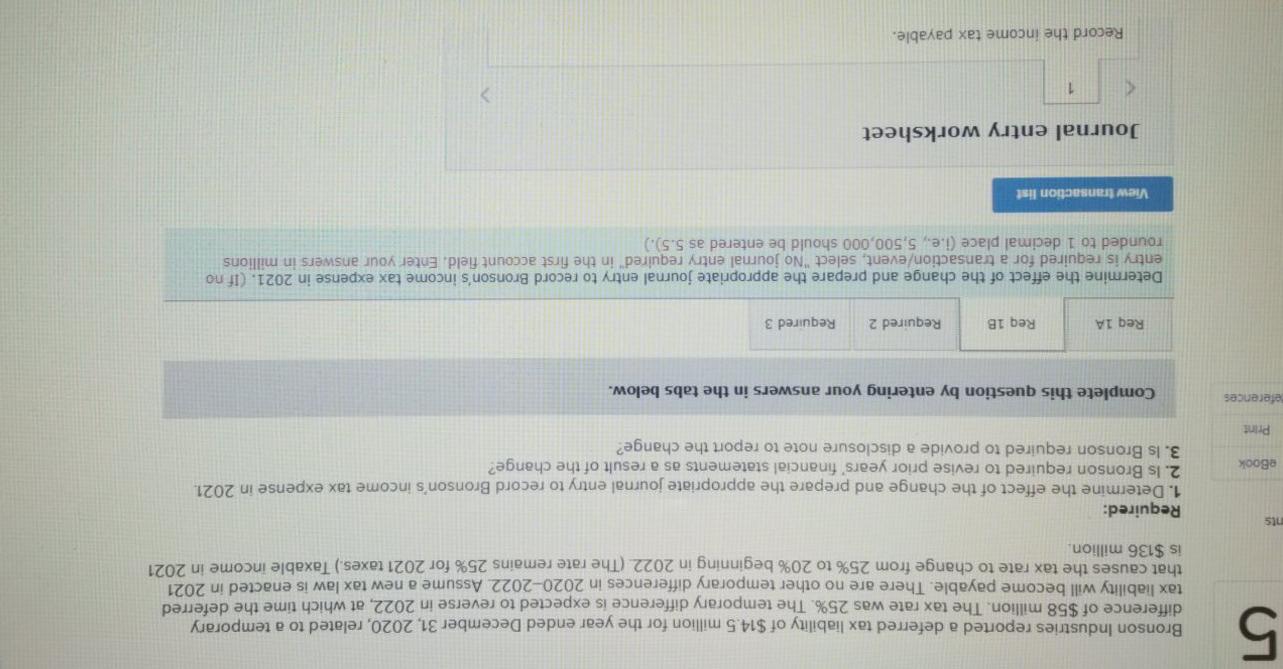

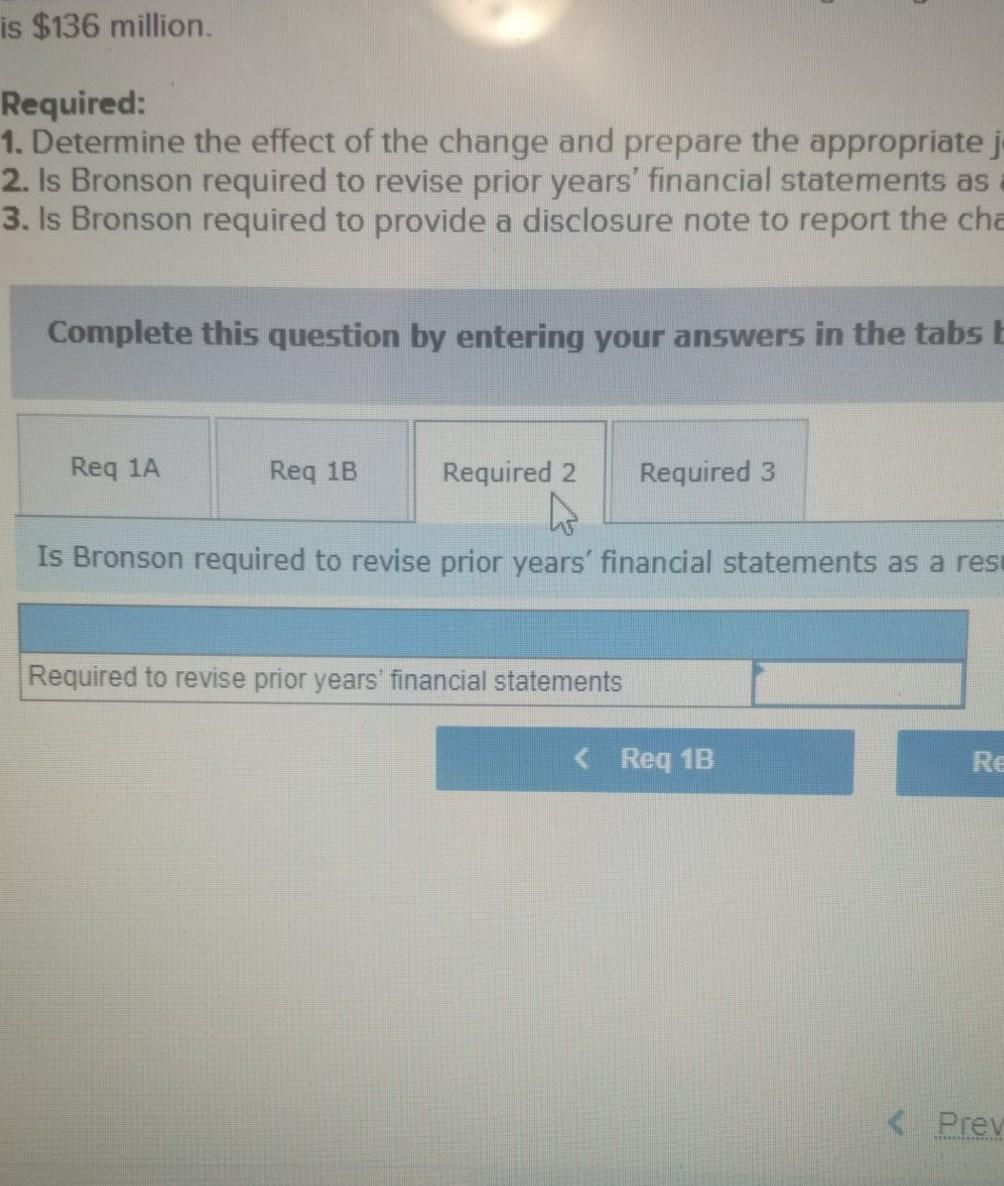

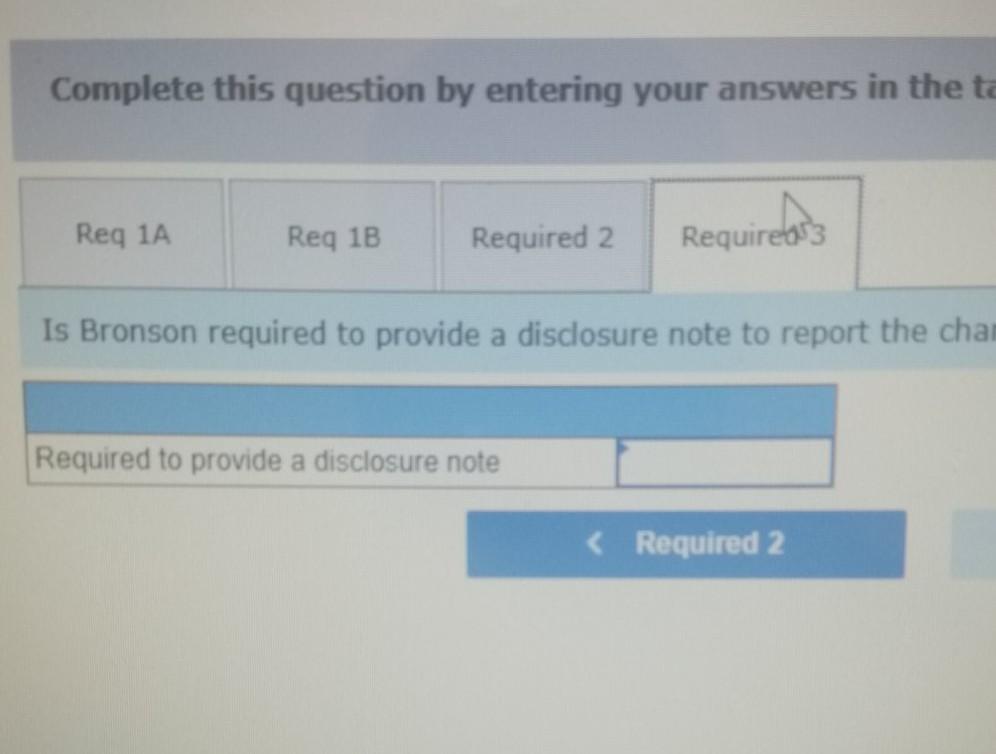

Bronson Industries reported a deferred tax liability of $14.5 million for the year ended December 31, 2020, related to a temporary difference of $58 million. The tax rate was 25%. The temporary difference is expected to reverse in 2022, at which time the deferred tax liability will become payable. There are no other temporary differences in 2020-2022. Assume a new tax law is enacted in 2021 that causes the tax rate to change from 25% to 20% beginning in 2022. (The rate remains 25% for 2021 taxes.) Taxable income in 2021 is $136 million Required: 1. Determine the effect of the change and prepare the appropriate journal entry to record Bronson's income tax expense in 2021. 2. Is Bronson required to revise prior years financial statements as a result of the change? 3. Is Bronson required to provide a disclosure note to report the change? aces Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Required 2 Required 3 Determine the type of accounting change. Type of change Reg 1B > Complete this question by entering your answers in the ta Req 1A Req 1B Required 2 Require03 Is Bronson required to provide a disclosure note to report the cha Required to provide a disclosure note

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts