Question: SHOW YOUR WORK! NO WORK SHOW IS ZERO POINT EVEN IF THE FINAL ANSWER IS CORRECT! QUESTION 1- INVESTMENT DECISION RULES (25 POINTS) PART A.

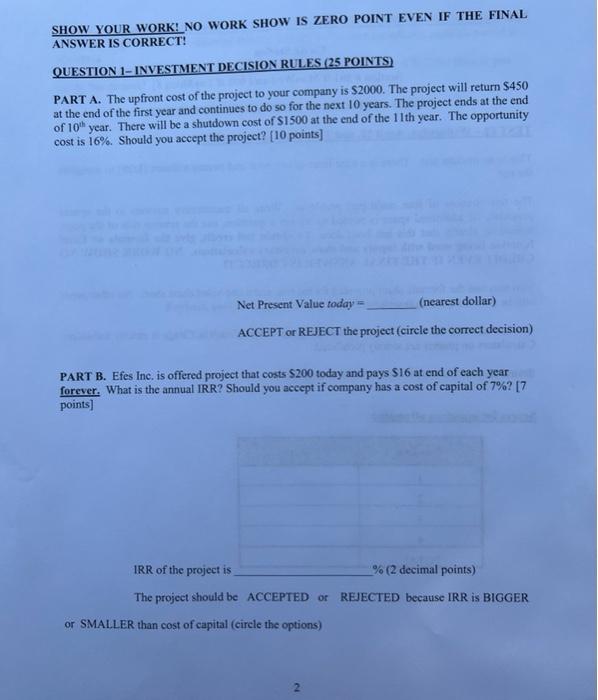

SHOW YOUR WORK! NO WORK SHOW IS ZERO POINT EVEN IF THE FINAL ANSWER IS CORRECT! QUESTION 1- INVESTMENT DECISION RULES (25 POINTS) PART A. The upfront cost of the project to your company is $2000. The project will return $450 at the end of the first year and continues to do so for the next 10 years. The project ends at the end of 10 year. There will be a shutdown cost of S1500 at the end of the 11th year. The opportunity cost is 16%. Should you accept the project? [10 points) Net Present Value today (nearest dollar) ACCEPT O REJECT the project (circle the correct decision) PART B. Efes Inc. is offered project that costs $200 today and pays $16 at end of each year forever. What is the annual IRR? Should you accept if company has a cost of capital of 7%? [7 points) % (2 decimal points) IRR of the project is The project should be ACCEPTED or or SMALLER than cost of capital (circle the options) REJECTED because IRR is BIGGER 2 PART C. Annual cash inflows of a project are $2,800, S3,700, 85,100, and $4,300, for the next four years, respectively. The discount rate is 14 percent. The firm's preferred payback period is two years. What is the payback period for these cash flows if the initial cost today is $5.200? Should you accept this project? [8 points) Payback period is years (2 decimal points) ACCEPT or REJECT the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts