Question: Show your work not on excel ! I don't have a financial calculator. This is the only information I have. Q1. Calculate the present value

Show your work not on excel !

I don't have a financial calculator. This is the only information I have.

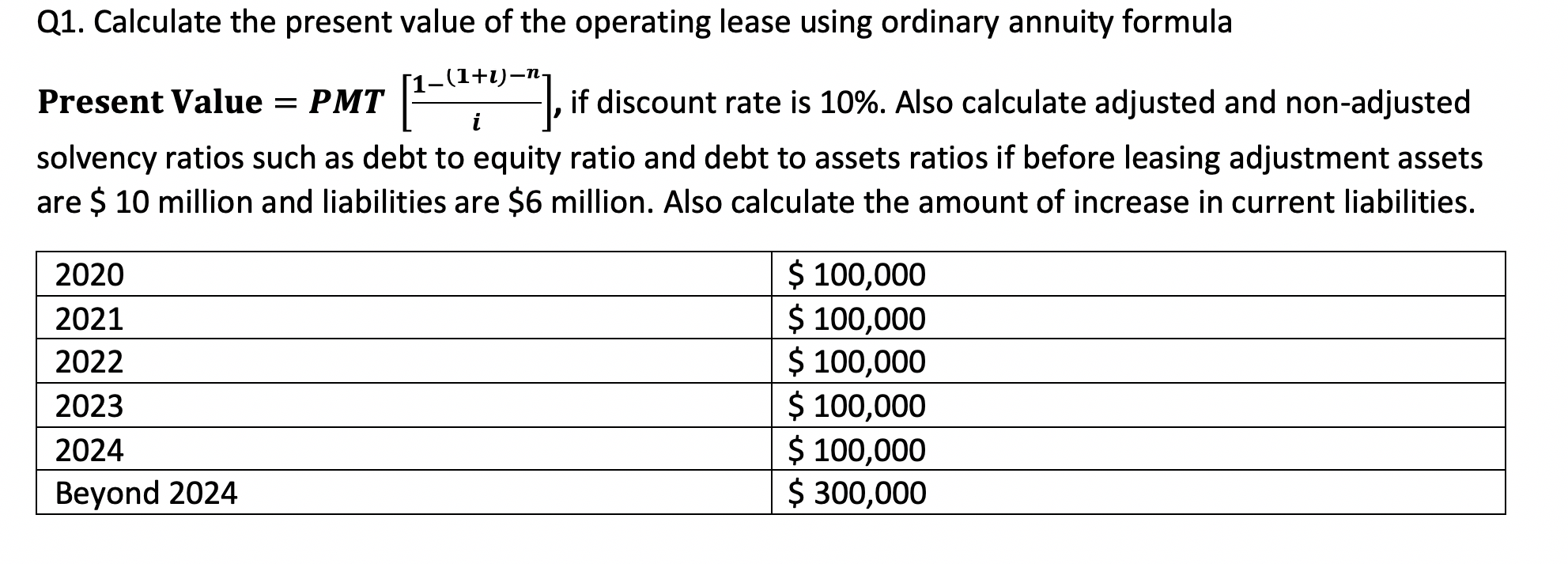

Q1. Calculate the present value of the operating lease using ordinary annuity formula 11-(1+1)-n, Present Value = PMT , if discount rate is 10%. Also calculate adjusted and non-adjusted solvency ratios such as debt to equity ratio and debt to assets ratios if before leasing adjustment assets are $ 10 million and liabilities are $6 million. Also calculate the amount of increase in current liabilities. 2020 $ 100,000 2021 $ 100,000 2022 $ 100,000 2023 $ 100,000 2024 $ 100,000 Beyond 2024 $ 300,000 Q1. Calculate the present value of the operating lease using ordinary annuity formula 11-(1+1)-n, Present Value = PMT , if discount rate is 10%. Also calculate adjusted and non-adjusted solvency ratios such as debt to equity ratio and debt to assets ratios if before leasing adjustment assets are $ 10 million and liabilities are $6 million. Also calculate the amount of increase in current liabilities. 2020 $ 100,000 2021 $ 100,000 2022 $ 100,000 2023 $ 100,000 2024 $ 100,000 Beyond 2024 $ 300,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts