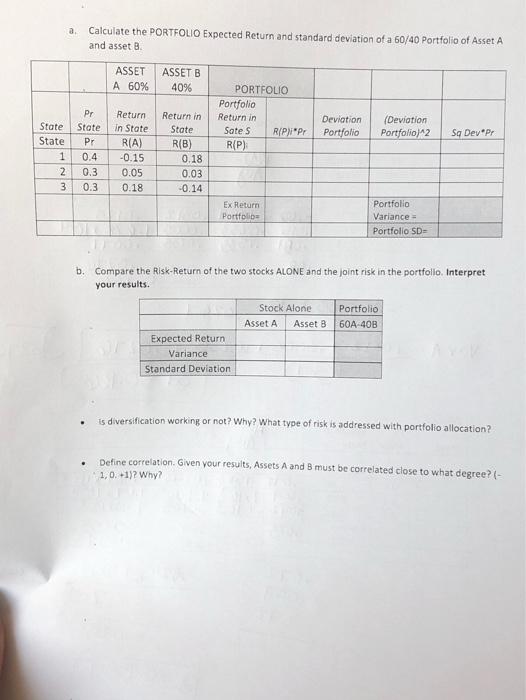

Question: show your work please a Calculate the PORTFOLIO Expected Return and standard deviation of a 60/40 Portfolio of Asset A and asset B ASSET A

a Calculate the PORTFOLIO Expected Return and standard deviation of a 60/40 Portfolio of Asset A and asset B ASSET A 60% ASSET B 40% Deviation Portfolio PORTFOLIO Portfolio Return in Sate s RIPPY R(P) (Deviation Portfolio)^2 Sa Dev Pr Pr State Pr 0.4 0.3 0.3 State State 1 2 3 Return in State R(A) -0.15 0.05 0.18 Return in State R(B) 0.18 0.03 -0.14 Ex Return Portfolio Portfolio Variance Portfolio SD- b. Compare the Risk Return of the two stocks ALONE and the joint risk in the portfolio Interpret your results. Stock Alone Asset A Asset B Portfolio 60A 40B Expected Return Variance Standard Deviation . is diversification working or not? Why? What type of risk is addressed with portfolio allocation? Define correlation. Given your results, Assets A and B must be correlated close to what degree?(- 1,0 +1)? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts