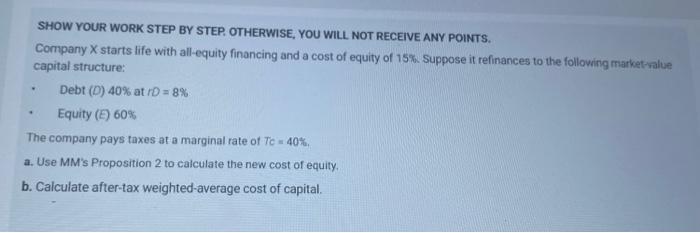

Question: SHOW YOUR WORK STEP BY STEP. OTHERWISE, YOU WILL NOT RECEIVE ANY POINTS. Company X starts life with all-equity financing and a cost of equity

SHOW YOUR WORK STEP BY STEP. OTHERWISE, YOU WILL NOT RECEIVE ANY POINTS. Company X starts life with all-equity financing and a cost of equity of 15% Suppose it refinances to the following market-value capital structure: Debt (D)40% at rD=8% Equity (E) 60% The company pays taxes at a marginal rate of Tc=40%. a. Use MM's Proposition 2 to calculate the new cost of equity, b. Calculate after-tax weighted-average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts