Question: Showing how to solve on TI BA ii plus helpful too Assume the returns of a stock for the previous five years are as follows:

Showing how to solve on TI BA ii plus helpful too

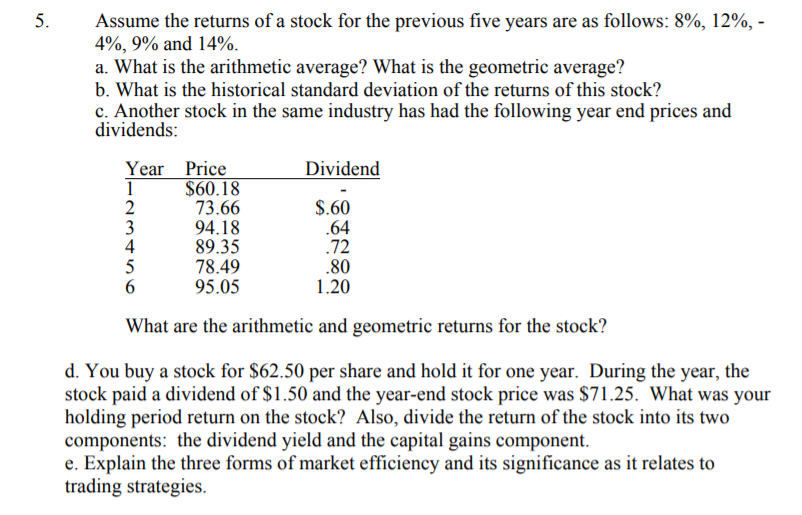

Assume the returns of a stock for the previous five years are as follows: 8%, 12%, - 4%, 9% and 14%. a. What is the arithmetic average? What is the geometric average? b. What is the historical standard deviation of the returns of this stock? c. Another stock in the same industry has had the following year end prices and dividends: Dividend Year Price $60.18 73.66 94.18 $.60 .64 89.35 .80 78.49 95.05 1.20 What are the arithmetic and geometric returns for the stock? d. You buy a stock for $62.50 per share and hold it for one year. During the year, the stock paid a dividend of $1.50 and the year-end stock price was $71.25. What was your holding period return on the stock? Also, divide the return of the stock into its two components: the dividend yield and the capital gains component. e. Explain the three forms of market efficiency and its significance as it relates to trading strategies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts