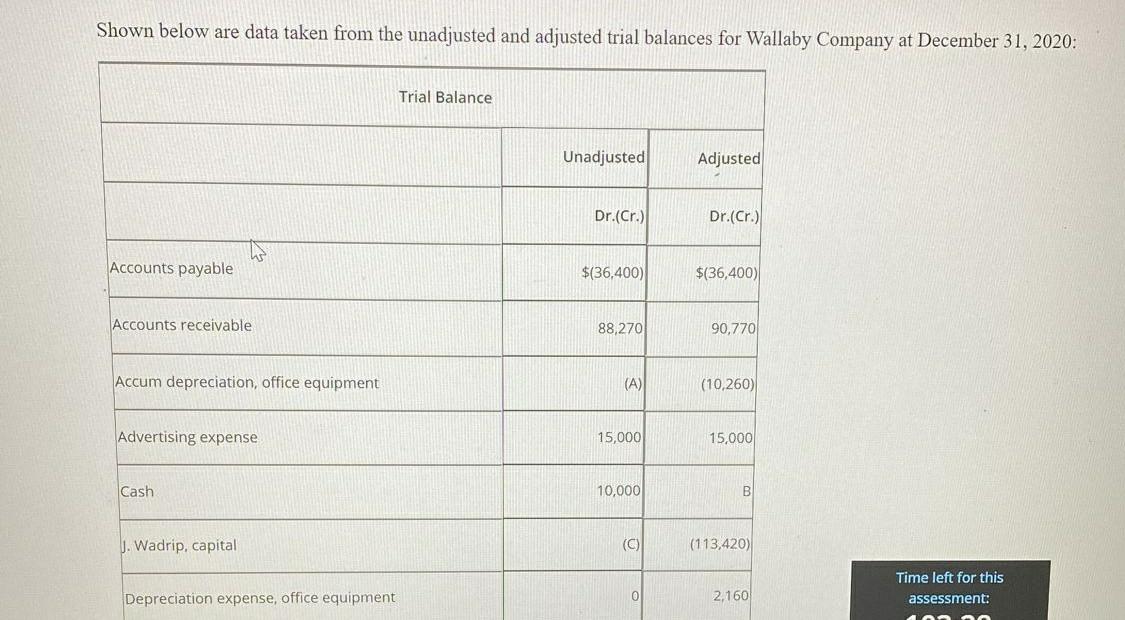

Question: Shown below are data taken from the unadjusted and adjusted trial balances for Wallaby Company at December 31, 2020: Trial Balance Unadjusted Adjusted Dr.(Cr.) Dr.(Cra

Shown below are data taken from the unadjusted and adjusted trial balances for Wallaby Company at December 31, 2020: Trial Balance

Unadjusted

Adjusted

Dr.(Cr.)

Dr.(Cra

Accounts payable

$36,400)

$136400)

Accounts receivable

88.270

Accum depreciation, office equipment

(10260)

Advertising expense

15,000

15,000

Cash

10,000

Wadrip, capital

13.4201

Time left for this

Depreciation expense, office equipment

2,160 insurance experise

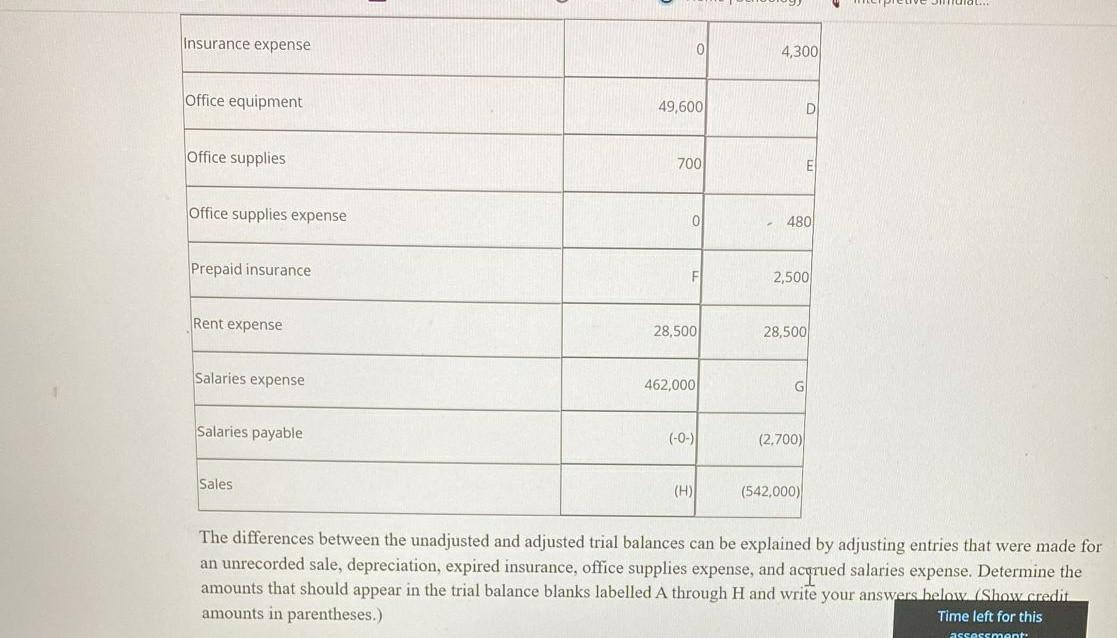

4,300

Office equipment

49,600

700

D

Office supplies

480

office supplies expense

Prepaid insurance

2,500

Rent expente

28.500

28500

Salaries expense

Salaries payable

462,000

G

12,700)

Sales

(542,000)

The differences between the unadjusted and adjusted trial balances can be explained by adjusting entries that were made for an unrecorded sale, depreciation, expired insurance, office supplies expense, and acqrued salaries expense. Determine the amounts that should appear in the trial balance blanks labelled A through H and write your answers below./Show.cruit amounts in parentheses)

A__ B__

C__ D__ E__ F__ G__ H__

Shown below are data taken from the unadjusted and adjusted trial balances for Wallaby Company at December 31,2020 : The differences between the unadjusted and adjusted trial balances can be explained by adjusting entries that were made for an unrecorded sale, depreciation, expired insurance, office supplies expense, and actrued salaries expense. Determine the amounts that should appear in the trial balance blanks labelled A through H and write your answers below (Show credit amounts in parentheses.) Time left for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts