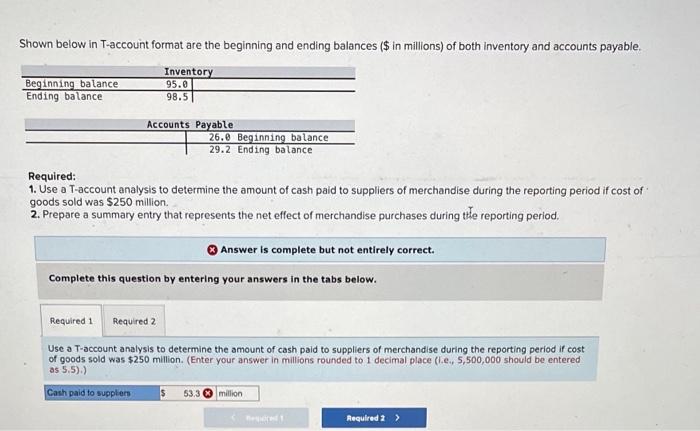

Question: Shown below in T-account format are the beginning and ending balances ($ in millions) of both inventory and accounts payable Inventory Beginning balance 95.0 Ending

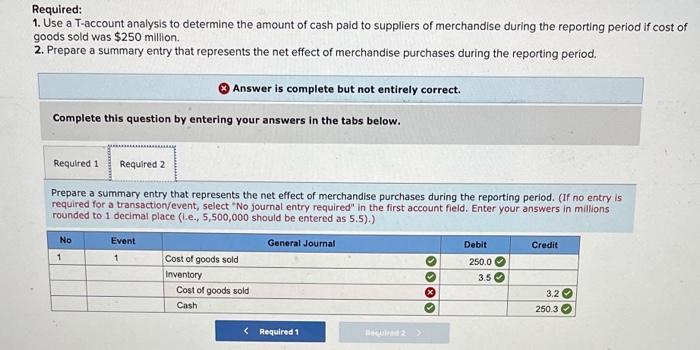

Shown below in T-account format are the beginning and ending balances ($ in millions) of both inventory and accounts payable Inventory Beginning balance 95.0 Ending balance 98.5 Accounts Payable 26.0 Beginning balance 29.2 Ending balance Required: 1. Use a T-account analysis to determine the amount of cash paid to suppliers of merchandise during the reporting period if cost of goods sold was $250 million 2. Prepare a summary entry that represents the net effect of merchandise purchases during tle reporting period, Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Use a T-account analysis to determine the amount of cash paid to suppliers of merchandise during the reporting period it cost of goods sold was $250 million. (Enter your answer in millions rounded to 1 decimal place (le, 5,500,000 should be entered as 5.5).) Cash paid to suppliers 5 53,33 million Required Required: 1. Use a T-account analysis to determine the amount of cash paid to suppliers of merchandise during the reporting period if cost of goods sold was $250 million. 2. Prepare a summary entry that represents the net effect of merchandise purchases during the reporting period. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a summary entry that represents the net effect of merchandise purchases during the reporting period. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (1.e., 5,500,000 should be entered as 5.5).) No Event General Journal Debit Credit 1 1 Cost of goods sold Inventory Cost of goods sold Cash 250.0 3.5 OOOO 3.2 250.3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts