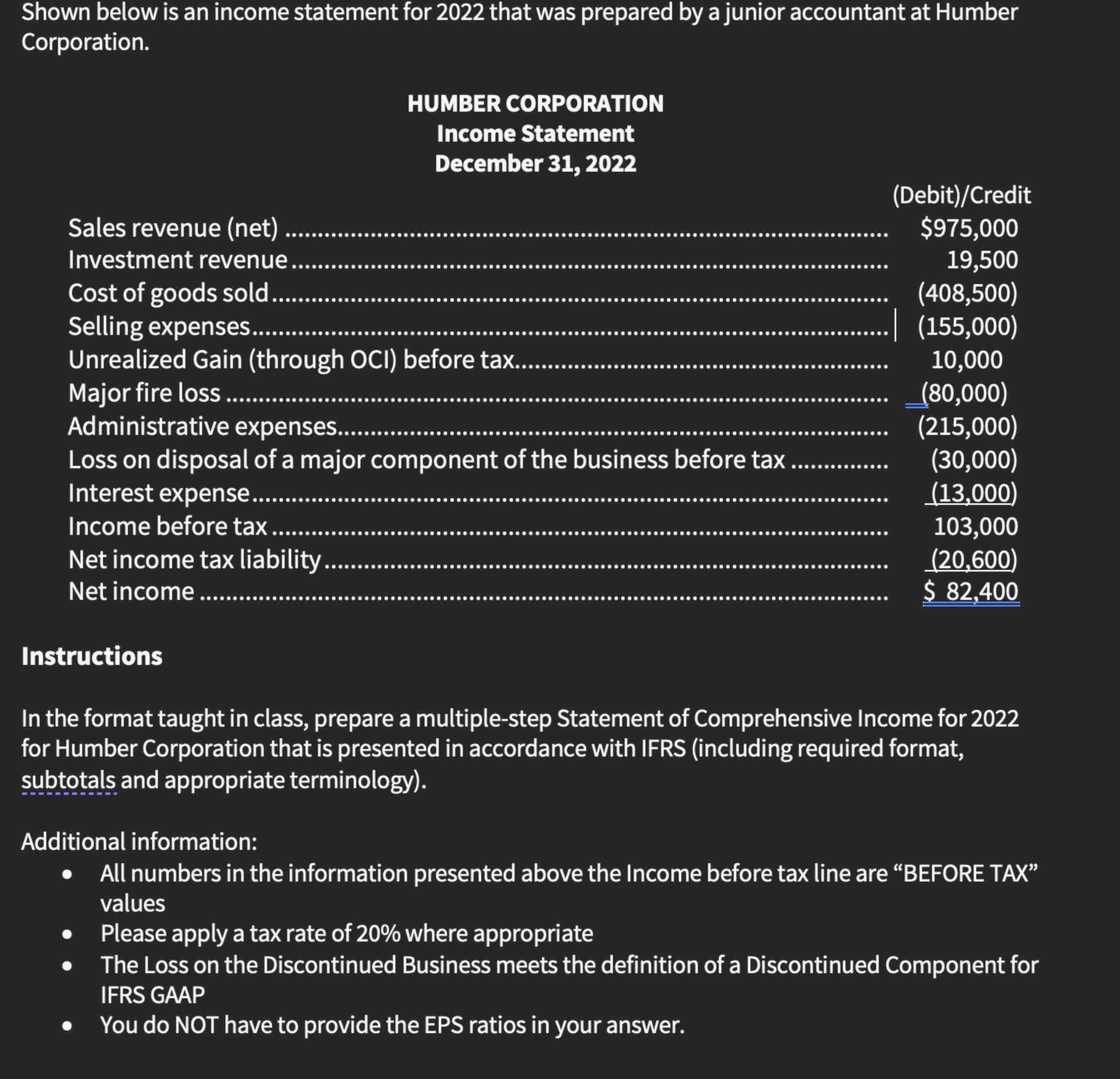

Question: Shown below is an income statement for 2 0 2 2 that was prepared by a junior accountant at Humber Corporation. HUMBER CORPORATION Income Statement

Shown below is an income statement for that was prepared by a junior accountant at Humber

Corporation.

HUMBER CORPORATION

Income Statement

December

Sales revenue net

Investment revenue

DebitCredit

Cost of goods sold.

$

Selling expenses.

Unrealized Gain through OCI before tax

Major fire loss.

Administrative expenses.

Loss on disposal of a major component of the business before tax

Interest expense.

Income before tax

Net income tax liability

Net income.

$

Instructions

In the format taught in class, prepare a multiplestep Statement of Comprehensive Income for

for Humber Corporation that is presented in accordance with IFRS including required format,

subtotals and appropriate terminology

Additional information:

All numbers in the information presented above the Income before tax line are "BEFORE TAX"

values

Please apply a tax rate of where appropriate

The Loss on the Discontinued Business meets the definition of a Discontinued Component for

IFRS GAAP

You do NOT have to provide the EPS ratios in your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock