Question: Shrell Inc. is interested to know the Weighted Average Cost of Capital for all its financing. Following is source and cost of financing information of

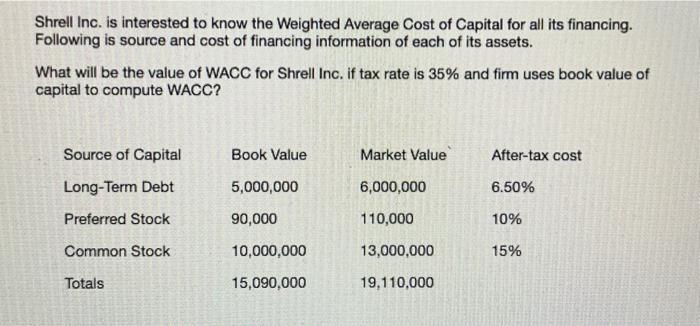

Shrell Inc. is interested to know the Weighted Average Cost of Capital for all its financing. Following is source and cost of financing information of each of its assets. What will be the value of WACC for Shrell Inc. if tax rate is 35% and firm uses book value of capital to compute WACC? Source of Capital Book Value Market Value After-tax cost Long-Term Debt 5,000,000 6,000,000 6.50% Preferred Stock 90,000 110,000 10% Common Stock 10,000,000 13,000,000 15% Totals 15,090,000 19,110,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock