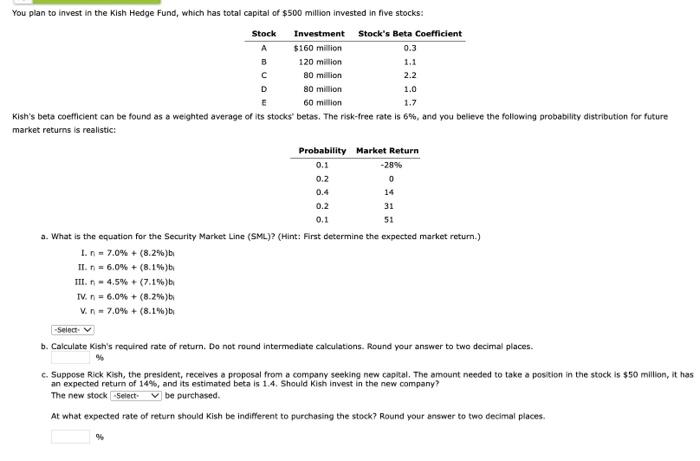

Question: sh's beta coeflcient can be found as a weighted average of its stocks' betas. The risk-free rate is 6%, and you believe the following probablity

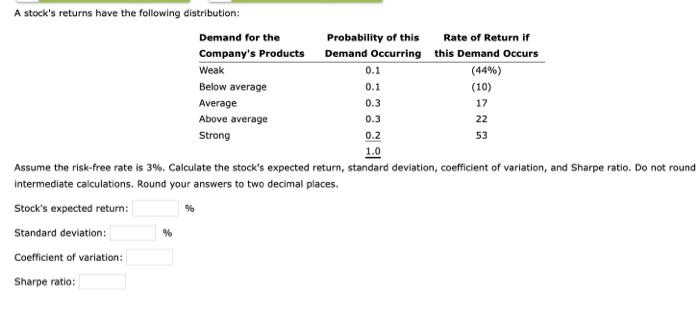

sh's beta coeflcient can be found as a weighted average of its stocks' betas. The risk-free rate is 6%, and you believe the following probablity distribution for future arket returns is realistic: a. What is the equation for the Security Market Line (SML)? (Hint: First determine the expected market return.) I. n=7.0%+(8.2%)b II. n=6.0%+(8.1%)bb IIt. f=4.5%+(7.1%)b TW. n=6.0%+(8.2%)br V. n=7.0%+(8.1%)br b. Calculate Kish's required rate of return. Do not round intermediate calculations. Round your answer to two decimal places. c. Suppose Rick Kish, the president, receives a proposal from a company seeking new capital. The amount needed to take a position in the stock is $50 million, it has an expected retum of 14\%, and its estimated beta is 1.4. Should Kish invest in the new company? The new stock be purchased. At what expected rate of return should Kish be indifferent to purchasing the stock? Round your answer to two decimal places. % A stock's returns have the following distribution: Assume the risk-free rate is 3%. Calculate the stock's expected return, standard deviation, coefficient of variation, and Sharpe ratio. Do not round intermediate calculations. Round your answers to two decimal places. Stock's expected return: 16 Standard deviation: 96 Coefficient of variation: Sharpe ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts