Question: Sid and Nancy, both are aged 5 6 , were married in 2 0 1 9 , and plan to file married filing jointly for

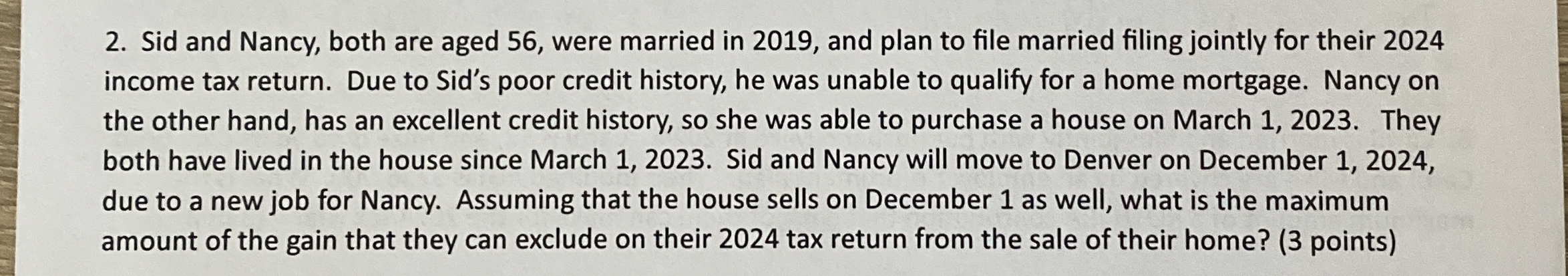

Sid and Nancy, both are aged were married in and plan to file married filing jointly for their income tax return. Due to Sid's poor credit history, he was unable to qualify for a home mortgage. Nancy on the other hand, has an excellent credit history, so she was able to purchase a house on March They both have lived in the house since March Sid and Nancy will move to Denver on December due to a new job for Nancy. Assuming that the house sells on December as well, what is the maximum amount of the gain that they can exclude on their tax return from the sale of their home? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock