Question: Sienna Company developed a specialized banking application software program that jt licenses to various financial institutions through multiple - year agreements. On January 1 ,

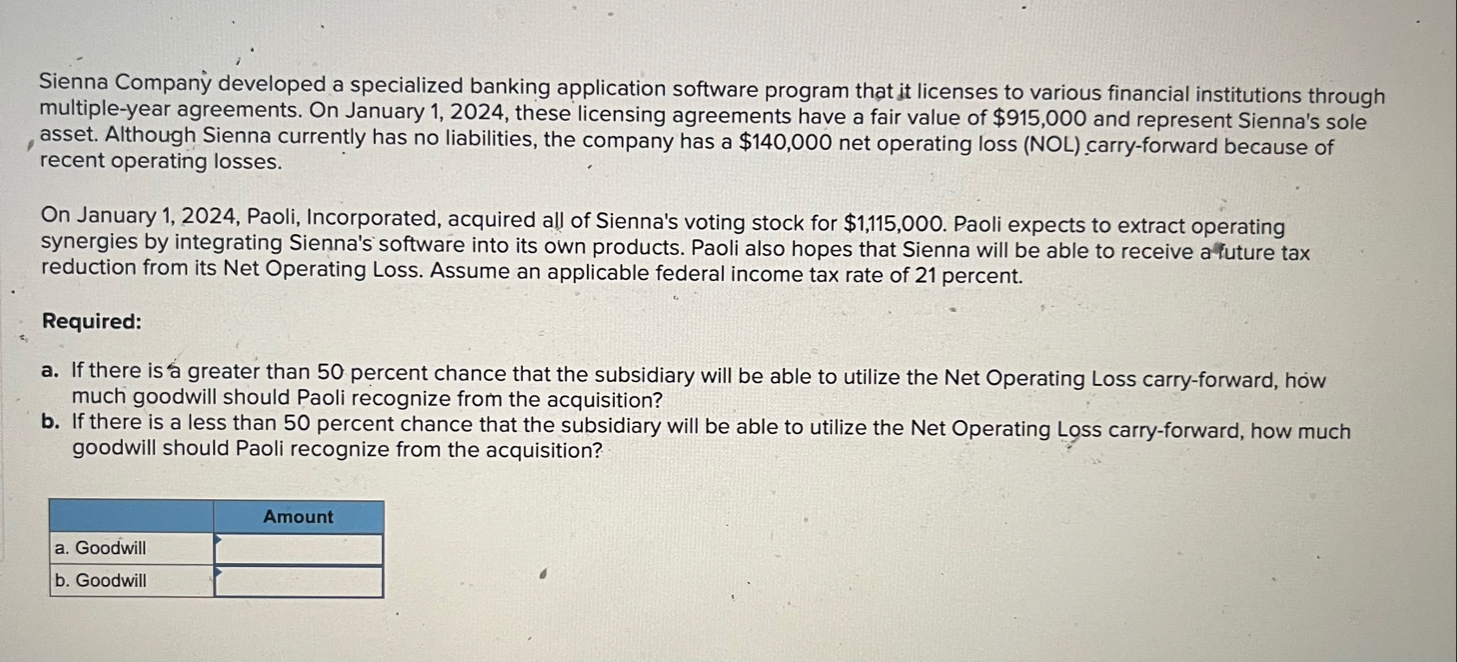

Sienna Company developed a specialized banking application software program that jt licenses to various financial institutions through multipleyear agreements. On January these licensing agreements have a fair value of $ and represent Sienna's sole asset. Although Sienna currently has no liabilities, the company has a $ net operating loss NOL carryforward because of recent operating losses.

On January Paoli, Incorporated, acquired all of Sienna's voting stock for $ Paoli expects to extract operating synergies by integrating Sienna's software into its own products. Paoli also hopes that Sienna will be able to receive afuture tax reduction from its Net Operating Loss. Assume an applicable federal income tax rate of percent.

Required:

a If there is greater than percent chance that the subsidiary will be able to utilize the Net Operating Loss carryforward, how much goodwill should Paoli recognize from the acquisition?

b If there is a less than percent chance that the subsidiary will be able to utilize the Net Operating Loss carryforward, how much goodwill should Paoli recognize from the acquisition?

tableAmounta Goodwill,b Goodwill,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock