Question: Sign in Share Comments X X TL 721 - Assignment 121) - Protected View - Saved to this PC- Search Pic Home Insert Design Layout

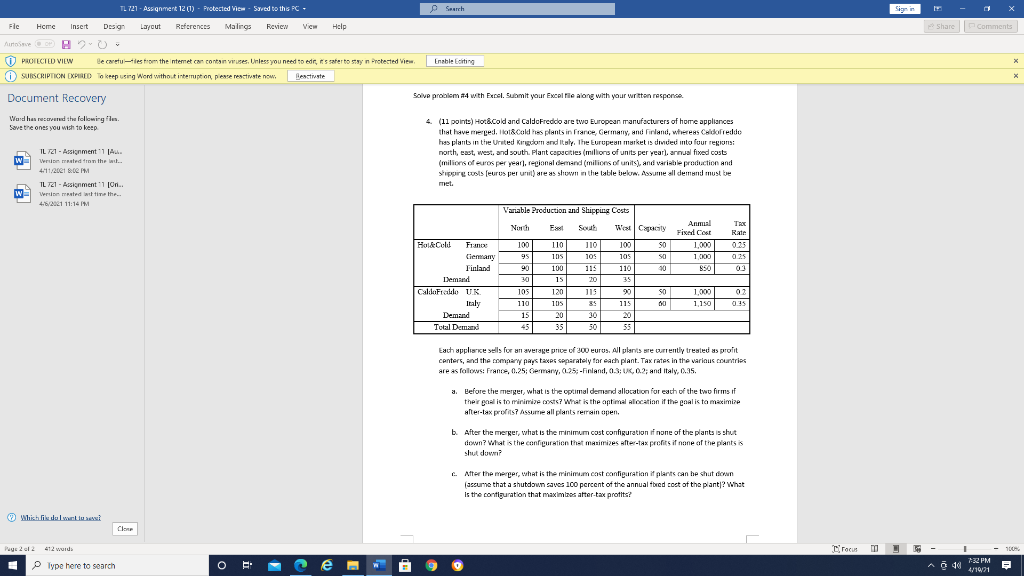

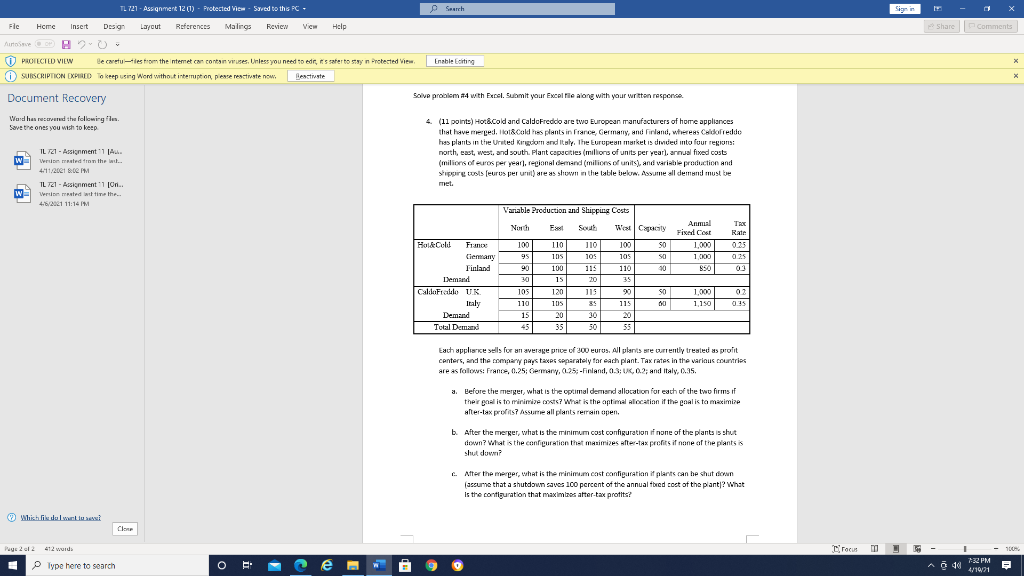

Sign in Share Comments X X TL 721 - Assignment 121) - Protected View - Saved to this PC- Search Pic Home Insert Design Layout References Malings Review View Help AutoSave B20 PROTECTED VIEW Be caretulestrom the nternet can contain viruses. Unless you need to edir, sster to stay in Protected View Enable Corting SUBSCRIPTION EXPIRED To keep using Word without interruption, please reactivate now, Document Recovery Solve problem with Excel Submit your Excele along with your written responde Ward has received the following files Save the ones you wish to keep 4 (11 points) Hot&cold and Caldo Freddo are two European manufacturers of home appliances that have merged, o&Cold Hes plants in France Germany, and Finland, whereas Correddo hess plants in the United Kingdom and Italy. The European market is drived into four regions: IL T21 - Assignment W Versi maled from the north, east, west, and south Plant capacities (millions of units per year). annual fixed costs (milions of euros per yearl, regional demand (milions of units), and variable production and 4.11.2001 Beim Spares (euros per tre shown in the table below. Assume all demand must be IL 721 - Assignment [Ori.. met. W W Versi mated with 4.6/2021 11:14 IM / Variable Production and Shipping Costs Anmal North El TRE Rate Hol&Colu France 100 110 110 100 SO 1,000 0.25 Ciermany ins 105 105 90 1 000 025 Finland 100 115 115 110 90 Demand 15 20 35 Caldo Fralo UK 105 120 115 90 SO 1,000 07 Italy 110 105 115 00 1.150 0.15 Demand 15 20 30 20 Total Demo 45 35 50 55 West City Field Cost Each appliare sells for an average price of 200 euros. All plants are currently treated as profit centers, and the company pays taxes separately for each plant. Tax rates in the various countries are as follows: France, 0.25: Germany, 0.25:-Finland, 03: UK, 0.2; and italy, 0.35. a. Before the merger, what is the optimal demand allocation for each of the two firms if their goal is to minimize ersts? What is the optimal location if the goal is to maximize alter-lax profits? Assume wil plants rerrain open. b. After the merger, what is the minimum cost configuration If none of the plants is shut down? What is the configuration that maximizes after-tax profits if none of the plants is shut down c. After the merger, what is the minimam cast configuration it plants can he shut down ascure that a shutdown saves 100 percent of the annual bred coct of the plant? What is the contiguration that maximizes after tax protits? Clone Puye 2012 412 wurde Crocus 100% Type here to search O E. 46 122 PM 4/19/21 F Sign in Share Comments X X TL 721 - Assignment 121) - Protected View - Saved to this PC- Search Pic Home Insert Design Layout References Malings Review View Help AutoSave B20 PROTECTED VIEW Be caretulestrom the nternet can contain viruses. Unless you need to edir, sster to stay in Protected View Enable Corting SUBSCRIPTION EXPIRED To keep using Word without interruption, please reactivate now, Document Recovery Solve problem with Excel Submit your Excele along with your written responde Ward has received the following files Save the ones you wish to keep 4 (11 points) Hot&cold and Caldo Freddo are two European manufacturers of home appliances that have merged, o&Cold Hes plants in France Germany, and Finland, whereas Correddo hess plants in the United Kingdom and Italy. The European market is drived into four regions: IL T21 - Assignment W Versi maled from the north, east, west, and south Plant capacities (millions of units per year). annual fixed costs (milions of euros per yearl, regional demand (milions of units), and variable production and 4.11.2001 Beim Spares (euros per tre shown in the table below. Assume all demand must be IL 721 - Assignment [Ori.. met. W W Versi mated with 4.6/2021 11:14 IM / Variable Production and Shipping Costs Anmal North El TRE Rate Hol&Colu France 100 110 110 100 SO 1,000 0.25 Ciermany ins 105 105 90 1 000 025 Finland 100 115 115 110 90 Demand 15 20 35 Caldo Fralo UK 105 120 115 90 SO 1,000 07 Italy 110 105 115 00 1.150 0.15 Demand 15 20 30 20 Total Demo 45 35 50 55 West City Field Cost Each appliare sells for an average price of 200 euros. All plants are currently treated as profit centers, and the company pays taxes separately for each plant. Tax rates in the various countries are as follows: France, 0.25: Germany, 0.25:-Finland, 03: UK, 0.2; and italy, 0.35. a. Before the merger, what is the optimal demand allocation for each of the two firms if their goal is to minimize ersts? What is the optimal location if the goal is to maximize alter-lax profits? Assume wil plants rerrain open. b. After the merger, what is the minimum cost configuration If none of the plants is shut down? What is the configuration that maximizes after-tax profits if none of the plants is shut down c. After the merger, what is the minimam cast configuration it plants can he shut down ascure that a shutdown saves 100 percent of the annual bred coct of the plant? What is the contiguration that maximizes after tax protits? Clone Puye 2012 412 wurde Crocus 100% Type here to search O E. 46 122 PM 4/19/21 F