Question: Silva Corp currently has debt outstanding with a face value of $7.5 million and a market value of $7.1 million. The CAPM beta coefficient for

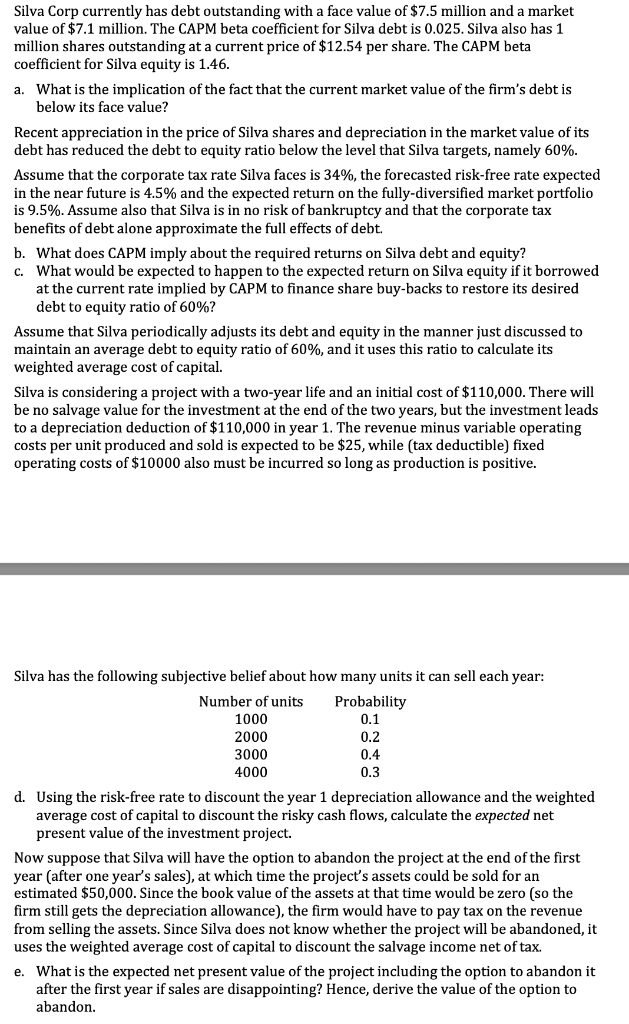

Silva Corp currently has debt outstanding with a face value of $7.5 million and a market value of $7.1 million. The CAPM beta coefficient for Silva debt is 0.025 . Silva also has 1 million shares outstanding at a current price of $12.54 per share. The CAPM beta coefficient for Silva equity is 1.46 . a. What is the implication of the fact that the current market value of the firm's debt is below its face value? Recent appreciation in the price of Silva shares and depreciation in the market value of its debt has reduced the debt to equity ratio below the level that Silva targets, namely 60%. Assume that the corporate tax rate Silva faces is 34%, the forecasted risk-free rate expected in the near future is 4.5% and the expected return on the fully-diversified market portfolio is 9.5%. Assume also that Silva is in no risk of bankruptcy and that the corporate tax benefits of debt alone approximate the full effects of debt. b. What does CAPM imply about the required returns on Silva debt and equity? c. What would be expected to happen to the expected return on Silva equity if it borrowed at the current rate implied by CAPM to finance share buy-backs to restore its desired debt to equity ratio of 60% ? Assume that Silva periodically adjusts its debt and equity in the manner just discussed to maintain an average debt to equity ratio of 60%, and it uses this ratio to calculate its weighted average cost of capital. Silva is considering a project with a two-year life and an initial cost of $110,000. There will be no salvage value for the investment at the end of the two years, but the investment leads to a depreciation deduction of $110,000 in year 1 . The revenue minus variable operating costs per unit produced and sold is expected to be $25, while (tax deductible) fixed operating costs of $10000 also must be incurred so long as production is positive. Silva has the following subjective belief about how many units it can sell each year: d. Using the risk-free rate to discount the year 1 depreciation allowance and the weighted average cost of capital to discount the risky cash flows, calculate the expected net present value of the investment project. Now suppose that Silva will have the option to abandon the project at the end of the first year (after one year's sales), at which time the project's assets could be sold for an estimated $50,000. Since the book value of the assets at that time would be zero (so the firm still gets the depreciation allowance), the firm would have to pay tax on the revenue from selling the assets. Since Silva does not know whether the project will be abandoned, it uses the weighted average cost of capital to discount the salvage income net of tax. e. What is the expected net present value of the project including the option to abandon it after the first year if sales are disappointing? Hence, derive the value of the option to abandon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts