Question: Silver Linings Ltd . commenced a mining operation in early 2 0 X 5 . The company is required by the terms of provincial legislation

Silver Linings Ltd commenced a mining operation in early X The company is required by the terms of provincial legislation to remediate the mine site when mining is completed, likely in five years time. Silver Linings Ltd estimates that this will cost $ A reasonable market interest rate is PV of $ PVA of $ and PVAD of $Use appropriate factors from the tables provided.Required:

Calculate the present value of the decommissioning obligation.

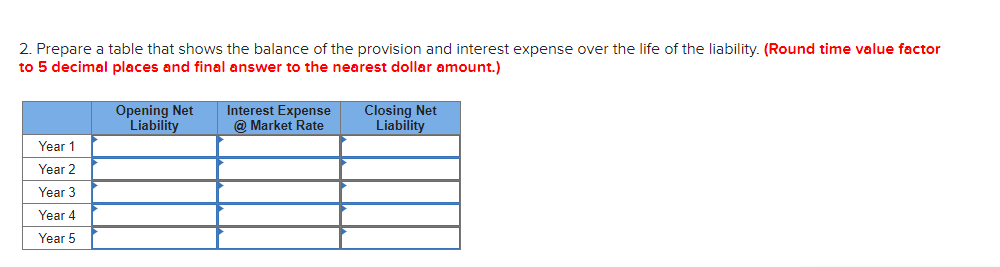

Prepare a table that shows the balance of the provision and interest expense over the life of the liability.

a Assume that at the end of X the company reestimates that the cost of remediation at $ Other assumptions are unchanged. Calculate the interest expense for X the new present value, and the adjustment to the obligation for the change in estimates.

b Prepare a table that shows the balance of the revised provision and interest expense over the life of the liability.

Assume that at the end of X the company reestimates the cost of remediation at $ and the market interest rate is now Calculate the interest expense for X the new present value, and the adjustment to the obligation for the change in estimates.

Calculate the balance of the decommissioning obligation at each December, from X to X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock