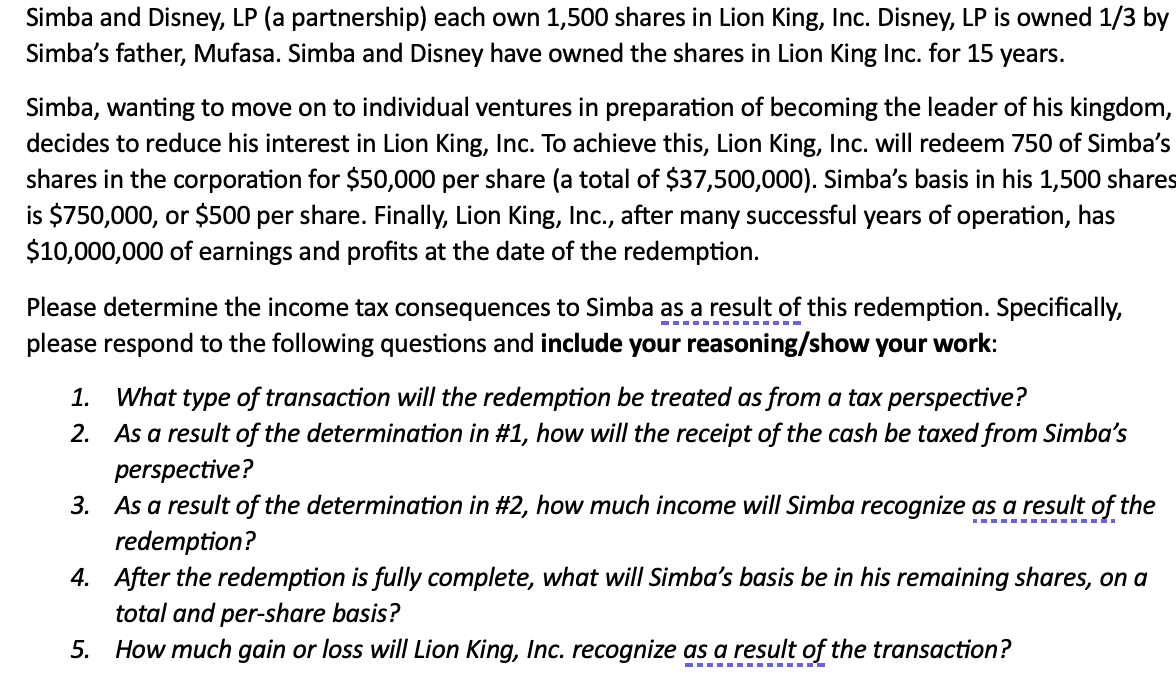

Question: Simba and Disney, LP ( a partnership ) each own 1 , 5 0 0 shares in Lion King, Inc. Disney, LP is owned 1

Simba and Disney, LP a partnership each own shares in Lion King, Inc. Disney, LP is owned by

Simba's father, Mufasa. Simba and Disney have owned the shares in Lion King Inc. for years.

Simba, wanting to move on to individual ventures in preparation of becoming the leader of his kingdom,

decides to reduce his interest in Lion King, Inc. To achieve this, Lion King, Inc. will redeem of Simba's

shares in the corporation for $ per share a total of $ Simba's basis in his shares

is $ or $ per share. Finally, Lion King, Inc., after many successful years of operation, has

$ of earnings and profits at the date of the redemption.

Please determine the income tax consequences to Simba as a result of this redemption. Specifically,

please respond to the following questions and include your reasoningshow your work:

What type of transaction will the redemption be treated as from a tax perspective?

As a result of the determination in # how will the receipt of the cash be taxed from Simba's

perspective?

As a result of the determination in # how much income will Simba recognize as a result of the

redemption?

After the redemption is fully complete, what will Simba's basis be in his remaining shares, on a

total and pershare basis?

How much gain or loss will Lion King, Inc. recognize as a result of the transaction?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock