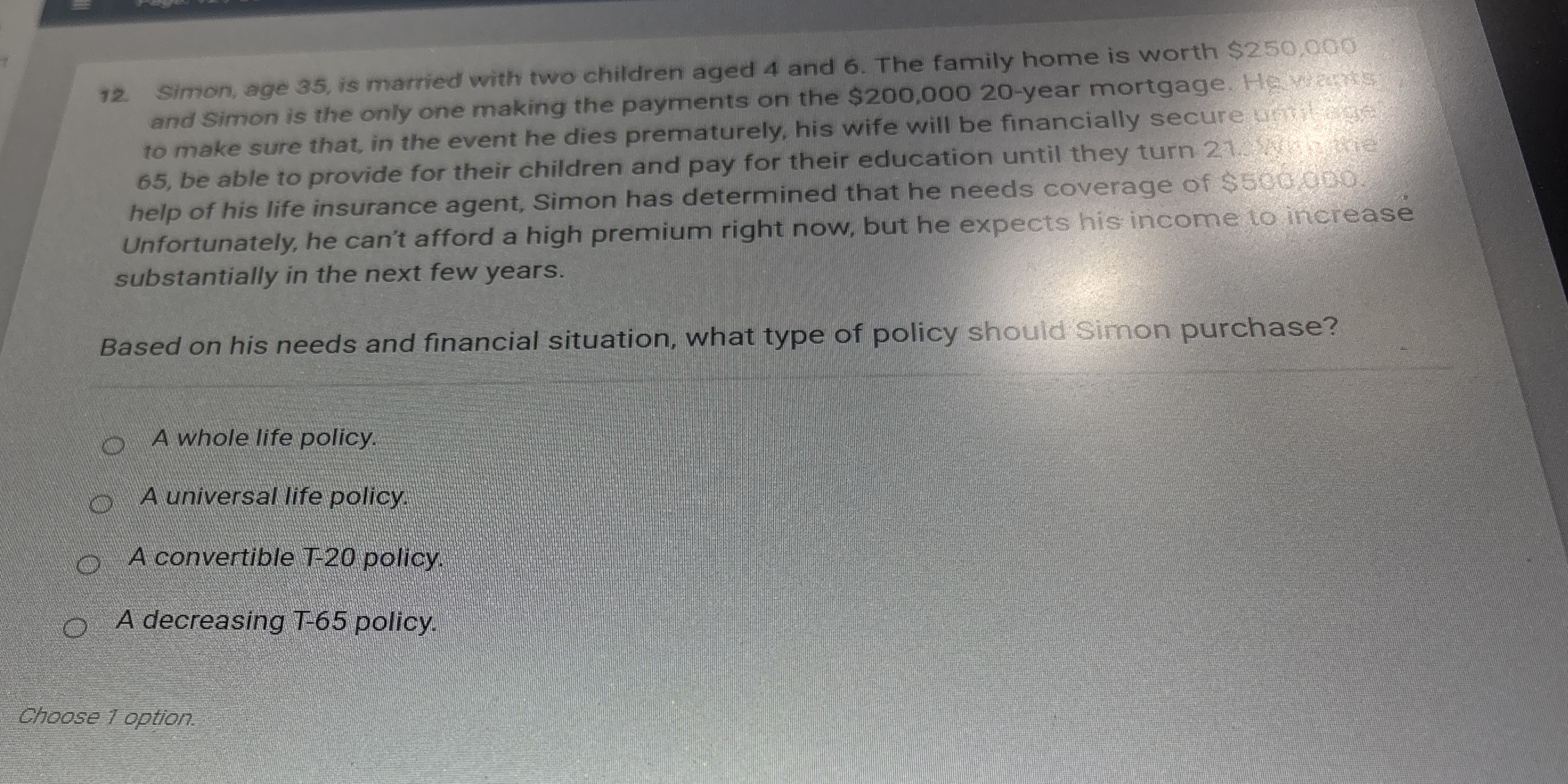

Question: Simon, age 3 5 , is married with two children aged 4 and 6 . The family home is worth $ 2 5 0 ,

Simon, age is married with two children aged and The family home is worth $ and simon is the only one making the payments on the $year mortgage. He werets. be able to provide for their children and pay for their education until they turn help of his life insurance agent, Simon has determined that he needs coverage of $ Unfortunately, he can't afford a high premium right now, but he expects his income lo increase substantially in the next few years.

Based on his needs and financial situation, what type of policy should Simon purchase?

A whole life policy.

A universal life policy.

A convertible T policy.

A decreasing T policy.

Choose option.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock