Question: Simon Company's year - end balance sheets follow. begin { tabular } { lrrr } hline At December 3 1 & Current Year

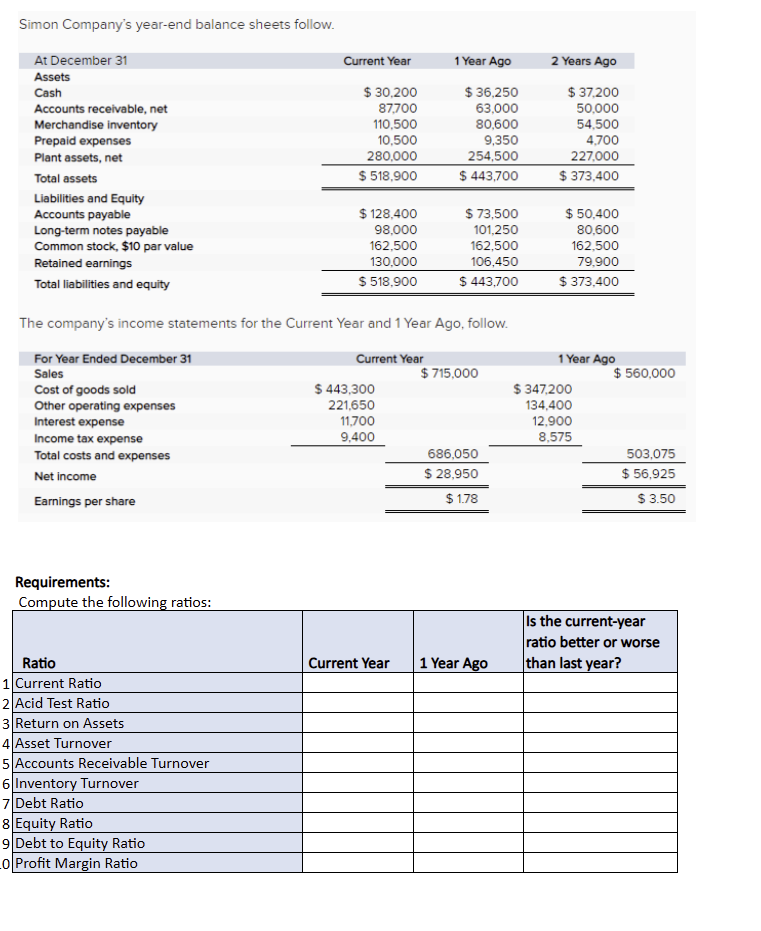

Simon Company's yearend balance sheets follow.

begintabularlrrr

hline At December & Current Year & Year Ago & Years Ago

hline Assets & & &

Cash & $ & $ & $

Accounts receivable, net & & &

Merchandise inventory & & &

Prepaid expenses & & &

Plant assets, net & & &

hline Total assets & $ & $ & $

hline Liabilities and Equity & & &

Accounts payable & $ & $ & $

Longterm notes payable & & &

Common stock, $

Retained earnings & & &

Total liabilities and equity & & &

hline

endtabular

The company's income statements for the Current Year and Year Ago, follow.

begintabularccccc

hline For Year Ended December & multicolumncCurrent Year & multicolumnc Year Ago

hline Sales & & $ & & $

hline Cost of goods sold & $ & & $ &

hline Other operating expenses & & & &

hline Interest expense & & & &

hline Income tax expense & & & &

hline Total costs and expenses & & & &

hline Net income & & $ & & $

hline Earnings per share & & $ & & $

hline

endtabular

Requirements:

Compute the following ratios:

begintabularlllll

hline & & & begintabularl

Is the currentyear

ratio better or worse

than last year?

endtabular

hline & Ratio & Current Year & Year Ago

endtabular

Current Ratio

Acid Test Ratio

Return on Assets

Asset Turnover

Accounts Receivable Turnover

Inventory Turnover

Debt Ratio

Equity Ratio

Debt to Equity Ratio

Profit Margin Ratio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock