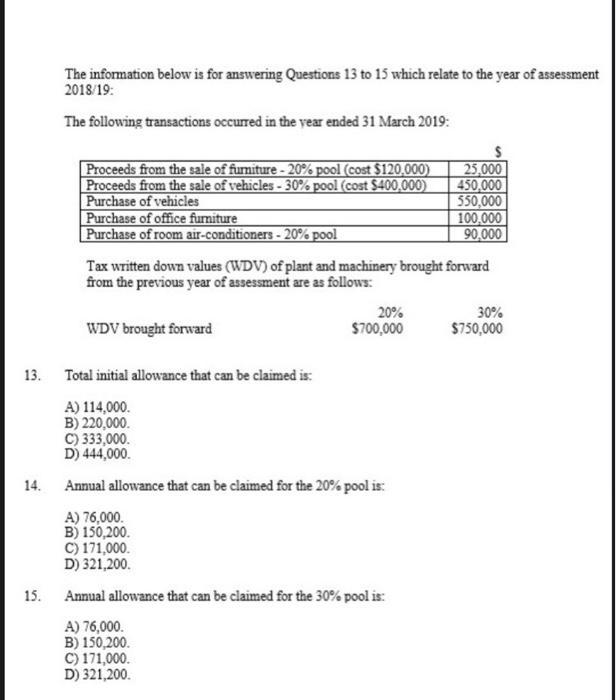

Question: 13. 14. The information below is for answering Questions 13 to 15 which relate to the year of assessment 2018/19: The following transactions occurred

13. 14. The information below is for answering Questions 13 to 15 which relate to the year of assessment 2018/19: The following transactions occurred in the year ended 31 March 2019: Proceeds from the sale of furniture - 20% pool (cost $120,000) Proceeds from the sale of vehicles -30% pool (cost $400,000) Purchase of vehicles Purchase of office furniture Purchase of room air-conditioners - 20% pool WDV brought forward Tax written down values (WDV) of plant and machinery brought forward from the previous year of assessment are as follows: 20% $700,000 Total initial allowance that can be claimed is: A) 114,000. B) 220,000. C) 333,000. D) 444,000. Annual allowance that can be claimed for the 20% pool is: A) 76,000. B) 150,200. 25,000 450,000 C) 171,000. D) 321,200. 15. Annual allowance that can be claimed for the 30% pool is: A) 76,000. B) 150,200. C) 171,000. D) 321,200. 550,000 100,000 90,000 30% $750,000

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

ANSWER 13 Total initial allowance that can be clai... View full answer

Get step-by-step solutions from verified subject matter experts