Question: SIMPLE DATA ANALYSIS With the dara you nous have in the financial statements and with the cell names that Wou have encoted in those financial

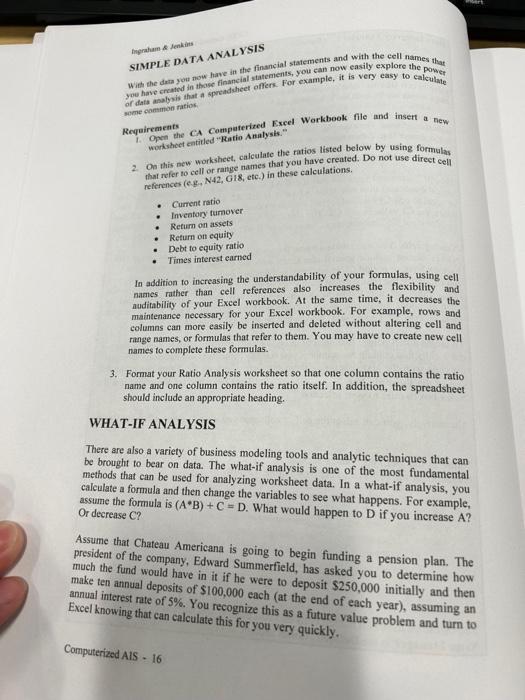

SIMPLE DATA ANALYSIS With the dara you nous have in the financial statements and with the cell names that Wou have encoted in those financial statements, you can now easily explore the potwer or dats anolysib that a spreadsheet offers. For example, it is very easy to calculate some cammon ratios. Requirements 1. Open the CA Compaterixed Excel Workbook file and insen a new 2. On this new worksheet, calculate the ratios listed below by using formulas On this new workshect, calculate the ratios listed bell or range names that you have created. Do not use direct cell references (eg. N42, G18, etc.) in these calculations. - Current ratio - Inveatory tumover - Return on assets - Return on equity - Debt to equity ratio - Times interest carned In addition to increasing the understandability of your formulas, using cell names ruther than cell references also increases the flexibility and auditability of your Excel workbook. At the same time, it decreases the maintenance necessary for your Excel workbook. For example, rows and columns can more easily be inserted and deleted without altering cell and range names, or formulas that refer to them. You may have to create new cell names to complete these formulas. 3. Format your Ratio Analysis worksheet so that one column contains the ratio name and one column contains the ratio itself. In addition, the spreadsheet should include an appropriate heading. WHAT-IF ANALYSIS There are also a variety of business modeling tools and analytic techniques that can be brought to bear on data. The what-if analysis is one of the most fundamental methods that can be used for analyzing worksheet data. In a what-if analysis, you calculate a formula and then change the variables to see what happens. For example, assume the formula is (AB)+C=D. What would happen to D if you increase A? Or decrease C ? Assume that Chateau Americana is going to begin funding a pension plan. The president of the company, Edward Summerfield, has asked you to determine how much the fund would have in it if he were to deposit $250,000 initially and then make ten annual deposits of $100,000 each (at the end of each year), assuming an annual interest rate of 5%. You recognize this as a future value problem and turn to Excel knowing that can calculate this for you very quickly. Computerized AIS - 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts