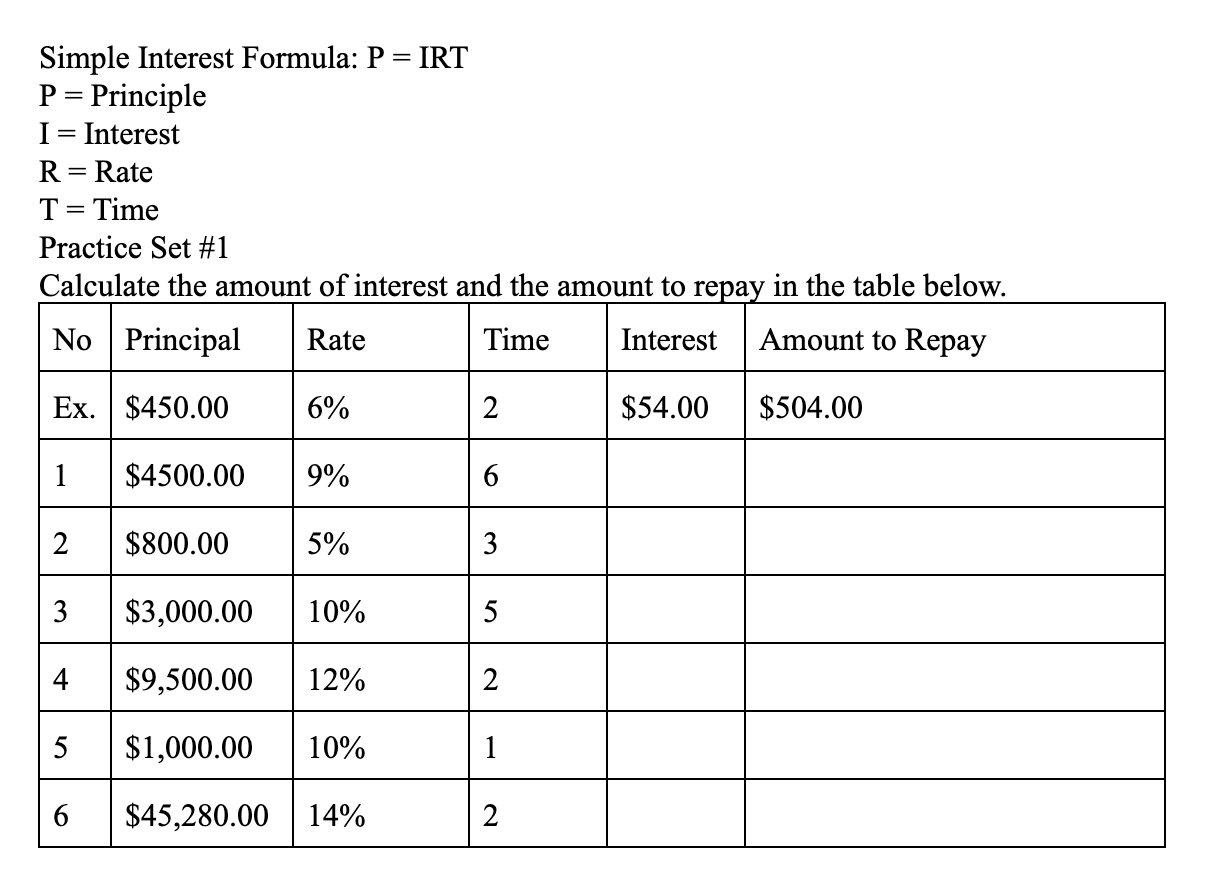

Question: Simple Interest Formula: P = IRT P = Principle I = Interest R = Rate T = Time Practice Set #1 Calculate the amount

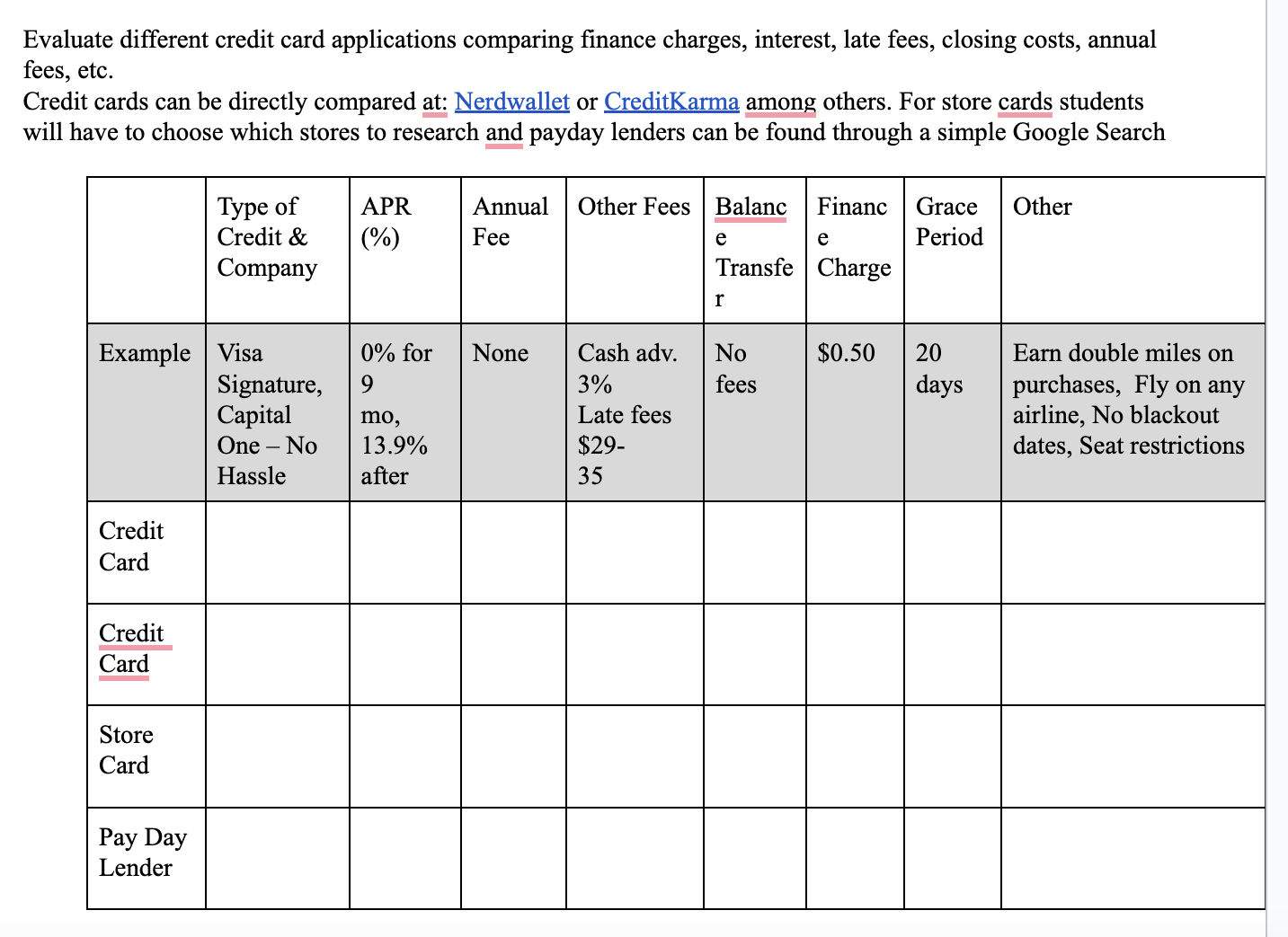

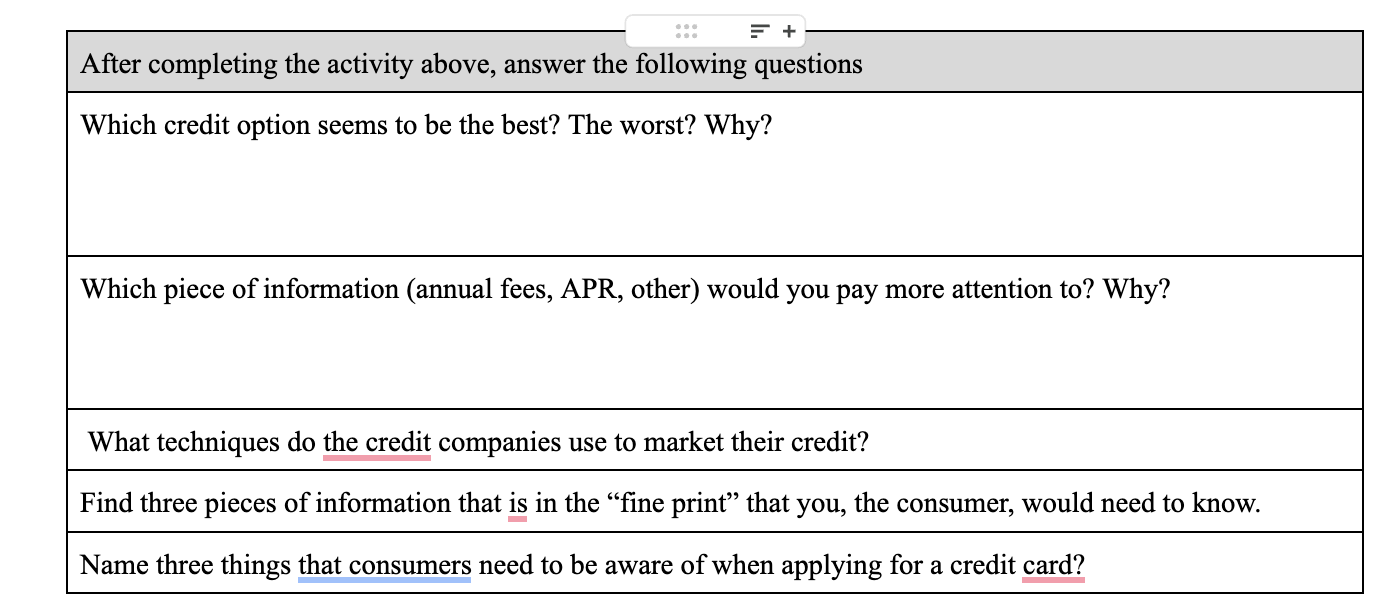

Simple Interest Formula: P = IRT P = Principle I = Interest R = Rate T = Time Practice Set #1 Calculate the amount of interest and the amount to repay in the table below. No Principal Rate Time Interest Amount to Repay Ex. $450.00 $504.00 1 $4500.00 $800.00 5% $3,000.00 10% $9,500.00 12% 5 $1,000.00 2 3 4 6% 6 9% 10% $45,280.00 14% 2 3 5 2 1 2 $54.00 Evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees, etc. Credit cards can be directly compared at: Nerdwallet or CreditKarma among others. For store cards students will have to choose which stores to research and payday lenders can be found through a simple Google Search Example Visa Credit Card Credit Card Store Card Type of Credit & Company Pay Day Lender Signature, Capital One - No Hassle APR (%) Annual Other Fees Balanc Financ Grace Fee Period 0% for None 9 mo, 13.9% after Cash adv. 3% Late fees $29- 35 e Transfe Charge e r No fees $0.50 20 days Other Earn double miles on purchases, Fly on any ine, No blackout dates, Seat restrictions = + After completing the activity above, answer the following questions Which credit option seems to be the best? The worst? Why? Which piece of information (annual fees, APR, other) would you pay more attention to? Why? What techniques do the credit companies use to market their credit? Find three pieces of information that is in the "fine print" that you, the consumer, would need to know. Name three things that consumers need to be aware of when applying for a credit card?

Step by Step Solution

There are 3 Steps involved in it

Practice Set 1 No Principal Rate Time Interest Amount to Repay 1 450000 9 6 243000 693000 2 80000 5 3 12000 92000 3 300000 10 12 360000 660000 4 95000... View full answer

Get step-by-step solutions from verified subject matter experts